INTRODUCTION

Traditionally, the 18th century extends from 1688 to 1815 under the convention that homogeneous historical changes are observed from the Glorious Revolution to the Battle of Waterloo. This long eighteenth century thus encompasses a sustained economic growth that is based on new agricultural techniques, on population growth, and on the beginning of the Industrial Revolution, with Great Britain as the main actor. This prominence is evident not only in the technological transformations that promote agriculture and trade, but also in the impact caused by the theoretical advances of economic thinkers.

The prosperity of the eighteenth century, which represents a break with the economic crises that occurred during the previous century, opens the spectrum for the appearance of various economic thinkers who established the principles of classical liberal thought and of a western capitalist system. The schools of economic thought will be represented by the mercantilists, the Physiocrats, then the classical thinkers like Adam Smith, Thomas Malthus, and David Ricardo. Although all agreed that the forces of the economy could be represented rationally, there were profound differences on best economic practices.

On the one hand, the thinkers of mercantilism were against international free trade because they had the conviction of a zero sum: while some gained from commercial transactions, others lost; therefore, the best economic policy was protectionism. On the other hand, the Physiocrats, and thinkers like Adam Smith and David Ricardo, were convinced that, through international trade, nations earned a positive sum, that is, trade brought profits for both buyers and sellers. In the free market, while competition allows better products at lower prices, buyers can survive and continue to enrich themselves.

Another very clear difference is the demographic perspective in relation to economic development. While Thomas Malthus believed that the increase in population would bring misery and poverty, Adam Smith and David Ricardo believed that population growth came hand in hand with economic development and that, with the use of technology, the increase in buyers as well as the increase in producers would bring prosperity to the nations. However, this prosperity would only be possible in a free market where prices and quantities are established through free competition.

On the conception of natural law, that is, that morality can be discovered through reason, the Physiocrats believed that the economy developed through natural laws came inherently in the human being and in their social relationships. These economic natural laws are based on the idea that human beings always want to benefit, in the case of buyers, good products at a lower price, and in the case of producers, lower costs and higher profits.

The research questions that lead the essay were: What are the main differences among the schools of thought and the economic thinkers? What are their main similitudes? Is this century the foundation of a capitalist future? The problem of the article is the systematic revision of the development of the economic thought in order to appreciate the similitudes and differences, taking into account that, even though this century is considered as the philosophical foundation of the economic thought, its representatives did not agree in specific issues. Thus, this revision has the objective is to present the arguments of the most important thinkers of the eighteenth century as the foundation of a Modernity characterized by the economic growth based on the free market.

METODOLOGY

The article has taken into consideration two main methodological approaches: first, the bibliographical; second, the heretical. The bibliographical approach has become an essential tool to discriminate the previous written works within the topic. Two criteria were selected for this discrimination: first, original works from the authors studied; and, second, the most relevant analysis published in well known and cited articles or books about the eighteenth century and the economic thought that emerged in this century. In this way, this essay revises the eighteenth century economic thought within its historical context.

On the other hand, the hermeneutic approach has been used to read, interpret and analyze the most relevant propositions from the different economic schools of thought within the eighteenth century. These propositions have been analyzed having in mind their historical context and their theoretical presuppositions that come from earlier philosophical and theological approaches.

The article is divided in two sections. The first section builds the historical economic context in Europe in the eighteenth century. In this section, the context is built in three areas: the population growth; the expansion of the central banking and commerce; and, the agricultural revolution. The second section presents and analyses the economic thought of the century in five areas: mercantilism; phisiocracy; Adam Smith; Thomas Malthus; and, David Ricardo.

RESULTS AND DISCUSSION

The 18th century is full of technological and demographic changes, with relevant economic thinkers who, although they do not develop similar theories and, in fact, are critical of each other, they have a clear homogeneous basis, that is, the belief that economics can be analyzed through logic and human nature, in a kind of rational and coherent science. These economic thoughts are presented below within their historical context.

EUROPEAN ECONOMIC CONTEXT

The eighteenth century is rapidly putting aside the austerity and economic crisis of the seventeenth century, a crisis born from the Ice Age, inflation and the Thirty Years' War (De Vries 2009). The Little Ice Age caused huge economic losses in the agricultural sectors, as well as the increase of deaths from hypothermia, the decrease in birth rates, and greater cases of cannibalism (Working 2019). On the other hand, inflation was caused by the reduction of the agricultural supply, as well as by the increase in income that came from raw materials from the New World. Finally, the Thirty Years' War (1618-1648) destroyed central Europe, leaving behind millions of deaths and an immediate famine. This crisis culminated in a dramatic reduction in the European population (Zhang, Brecke, Lee, He & Zhang (2007).

Climatic changes gradually diminished during the seventeenth and eighteenth centuries, while the Peace of Westphalia (1648) had created a prolonged space of relative peace between the Catholic and Protestant kingdoms. The return to social and political stability is evident with population growth, the expansion of banking and commerce, and the agricultural revolution (Spielvogel 2004). This renewed economic expansion gave a great boost to the beginnings of industrialization.

POPULATION GROWTH

It is hasty to place causes and effects properly; nonetheless, the main questions on population growth are: was economic growth the cause of population expansion? Or was population expansion the cause of economic growth? Although the first option seems more intuitive, the most adequate presentation is an evident positive correlation between both facts. In fifty years, the population of this region grew by about fifty percent, mainly due to the use of new food crops such as potatoes and a decrease in epidemic diseases.

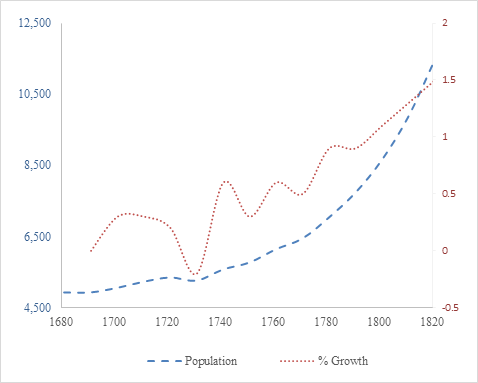

Krause (1958) suggests that if a population is growing rapidly it must be caused by a decrease in the death rate or an increase in the fertility rate, or a combination of both. However, this argument is based on a problem widely discussed by Wrigley (1994), the number of births and deaths far exceeded the number of registered baptisms and burials. Nonetheless, it is clear that the improvement of agricultural productivity is one of the most important elements to understand the growth of the population (Figure 1).

Europe's population doubled to nearly 200 million during the eighteenth century (Baird 2010). Likewise, Spielvogel (2004) indicates that the European population grew from 120 million inhabitants in 1700 to 140 million in 1750, and 190 million in 1790. This change can be understood by the care of all infants, not only the first-born, in addition to pressuring upper-class women to breastfeed their own children, and not leaving this practice in the hands of nurses.

The changing practices of caring for children helped population growth, although the practices of infanticide were maintained. Infant death was the most viable option for food shortages and economic problems,

until the middle of the 18th century, this practice of indirect infanticide did not diminish, which made it easier for people to become conscious or unconsciously, some mothers got rid of their children by suffocating them while they slept with them. (Rodríguez 2018:295)

Population growth forced peasant children to engage in new forms of paid work, their space in the labor market increased as demand grew in Europe and the world. Production expanded at the end of the century, one of the causes was the new consumption of rural wage earners, who bought the same merchandise they produced, while urban middle-class families enjoyed new tastes such as books or toys for their children.

EXPANSION OF CENTRAL BANKING AND COMMERCE

The proliferation of central banking dates back to the seventeenth and eighteenth centuries. The most relevant was the Swedish central bank, founded in 1668, then, in 1694, the Bank of England. The first central banks issued private banknotes that served as currency. Central banks helped finance government debt, while trying to sustain price stability through money circulation. The banking system provided financial security to the states, landowners and nobles.

Johan Palmstruch, after several negotiations with the kings of Sweden, founded the Bank of Stockholm (1656), the first Swedish bank. In 1661, Palmstruch issued the first banknotes that could be exchanged for coins at any time. This form of currency was quickly accepted by Swedish society. However, the temptations to issue more notes than the saved coins led to bankruptcy. In 1668, the Central Bank of Sweden, Riksens Ständers Bank, was created from the experience of the Bank of Stockholm, becoming the oldest central bank in the world (Sveriges Riksbank 2020).

In 1694 the Bank of England was created through the association between King William III and the merchant William Patterson (1658-1719), who had become a lender to the crown. These loans, although they came from private hands, were made within a central banking figure. Patterson, unsurprisingly, was its founder and director, although he resigned after a year, he is also credited with founding the Royal Bank of Scotland in 1727. The Bank of England grew rapidly.

Private banking is proliferating significantly: by 1750 there were 20 banks; 30 banks in 1765; 50 banks in 1770; and, 70 banks in 1800 (Ashton 2006). Later, in 1800, the Banque de France was founded to promote economic recovery. In 1774, the banks of Amsterdam were open, the German princes like the Danish courts borrowed 2 million florins, a debt that multiplied to 12 million (Braudel 1984).

Given the low interest rates, many of the English capitalists began to invest in the metal industries and in railways, which stimulated national growth and production. Also, the production of textiles was among the most consumed and exported products, wool, cotton, silk and linen clothing accounted for two-thirds of England's exports at the beginning of the century. By the early nineteenth century, the textile industry began its growth journey with the use of steam machinery, as a result, production increased considerably (Taylor 1988).

The growing demand for textiles prompted new forms of production, such as that of Richard Arkwright (1732-1792), with his invention known as the water frame. This system consisted of a rotating frame with a hydraulic wheel. The water frame could rotate the thread faster. Because it worked efficiently, this system was adopted in many modern textile factories. International trade based on manufactures expanded significantly during the 18th century, which produced the high profits and promoted the development of the industry. In the words of Spielvogel (2004:660):

From 1726 to 1789, France's total exports quadrupled, while intra-European trade, which made up 75 per cent of these exports in 1716, comprised only 50 per cent of the total in 1789. This increase in overseas trade has made some historians speak of the emergence of a truly global economy in the eighteenth century.

Finally, the slave trade between Europe, Africa and America acquired a special importance for being one of the most profitable commercial enterprises. The transatlantic slave trade began in the sixteenth century, and it quickly became a very profitable venture for Portuguese, British, Spanish, French, and Dutch traders. Rönnbäck's (2018) estimates it reached about 11% of the British economy at the beginning of the 19th century.

AGRICULTURAL REVOLUTION

Improved agricultural techniques led to higher yields and better food quality: extension of farmland, introduction of new crops, and crop rotation, reallocation of land ownership to make farms more compact, as well as increased investment in new machinery, drainage, and new crop improvement methods. This growth supported the rapid growth of the population: from 1700 to 1790, England increased from 5 to 9 million people, Spain increased from 6 to 10 million, Brandergurg-Prussia from 1, 5 to 5.5 million (Spielvogel 2004) although for authors like Keeridge (2013), the agricultural revolution is a plausible argument only for the case of Great Britain and the Netherlands.

Riches (1967) suggests that the changes had a clear commercial purpose, the spirit of competition and financial growth was emerging in Europe, which led to experimenting with new methods and new crops. New techniques were beginning to be explored in Europe such as crop rotation as the main method to maintain the fertility of the land; in addition to the introduction of artificial grass, which made it possible to sustain a greater number of livestock, which served as a supplier of natural fertilizer, while consuming the crops necessary for the new rotation scheme. The development of cattle was made possible by their cooperation in the new farming systems and by the selective breeding of local cattle.

In Europe, the two-field crop rotation system was well known, the first being turned into pasture for a time to try to recover some of the nutrients from the plants. Later, a three-year, three-field crop rotation routine was employed, with a different crop in each of the two fields (Allen 1999). Lord Charles Townhend (1674-1738) invented a four-year crop rotation: wheat in the first year and turnips in the second, followed by barley, with clover in the third, and alfalfa in the fourth. Similar systems have been found in the Netherlands. Agriculture in Great Britain should be divided into three periods. From 1520 to 1739, the production doubled; from 1740 to 1800, production increased by 10 percent; from 1800 to 1850, production grew by approximately 65 percent. Authors such as Hoderness (1989) propose an even greater increase.

EUROPEAN ECONOMIC CONTEXT

The eighteenthth century is influenced by technological changes and economic growth shipping to Britain first, and then to all of Europe and the United States. This century has been characterized as the point of emergence of mercantilism first, then various theoretical foundations flourished from philosophy, natural theology, and political thought: from the Physiocrats of France to classical economists like Adam Smith, Thomas Malthus and David Ricardo.

The one with the greatest impact was Adam Smith, with his Wealth of Nations, the most influential work in economic theory in recent centuries. Smith affirmed that a free market has a natural regulatory pattern, to say: if there is a shortage of product, the price of products increases, while, if there is abundance, the prices will decrease. He opposed the mercantilist regulations of the markets, although he accepted government intervention in infrastructure, communications, and a national defense system.

After Smith, the most influential are Thomas Malthus and David Ricardo. The Reverend Malthus proposed that population growth occurs geometrically, while food production increases arithmetically. On the other hand, Ricardo, proposed the idea of comparative advantage, that is, countries can have an advantage over the rest if they specialize in efficient production of a good. In addition, he proposed the idea of differential rent theory and natural price.

Apart from their difference, all of them agreed on the nature of economics, meaning a state where humans behave in a rational way based on freedom. In the words of John Locke, the state all men are naturally in is “

” (Mack 2019:11).a state of perfect freedom to order their actions, and dispose of their possessions and persons, as they think fit, within the bounds of the law of nature, without asking leave, or depending upon the will of any other man

MERCANTILISM

Mercantilism appears as the economic thought from the 16th to the 18th centuries regarding trade. Its initial purpose was the promotion of the gold and silver trade as the basis of the economy of a nation, which required an increase in exports and a limit to imports such as the implementation of the Sugar Law of 1764 in the British Empire, which produced annoyances in the exporters of the American colony.

The merchants founded a new area of knowledge through pamphlets on the economic problems they encountered in their commercial relations. Many tended to an idea of nationalism that helps the citizens profit and the nation develop. Nicholas Machiavelli in his most relevant works, the Prince (1531), recommended political and economic policy regulations (Landreth and Colander 2006). Mercantilism comes from the Latin mercāns, popular in the 16th century, yet it barely appeared in the mid-18th century.

Thoman Mun (1571-1641) is considered to be the first of the English mercantilists who emphasized the importance of trade and the exchange of merchandise. He claimed that trade affirms the honor of the kingdom because it enriches the nation and the reputation of the king (Hinton 1955). The importance of international trade also lied on the idea of a trade with zero sum, that is, the commercial gains of one nation meant the loss of another. This idea was refuted by David Hume, Adam Smith, and David Ricardo, who affirmed that all nations benefit from cooperative trade, on the contrary.

The theory had an important influence on the international trade in gold and silver considered important for the prosperity of nations. At the same time, the demand for mental increased, the wealth of a country was measured by the amount of gold and silver it had. From the seventeenth century, gold and silver served as a backup, generally 20%-30% of banknotes. To sustain this economy, there was a need for a prosperous agriculture that avoided the importation of food, foster the increase of maritime power to control smuggling, and a strong imports tax (Wallerstein 2011).

Mercantilists argued that a strong nation should have a large, vibrant population that provides labor, but also becomes a market that generates strong demand. However, as the zero-sum conception was widespread, it was assumed that consumption should be kept to a minimum, especially for imported luxury goods, as they consumed valuable foreign exchange. Saving was a virtue that generate capital and investments.

The mercantilists would take on later fame also for their advances in the mathematical measurement of the economy. William Petty (1623-1687), English mercantilist, coming from a poor home, became a sailor, doctor, and the first economist to write on economic variables. He used arithmetic to understand politics and economics, in his book Political Arithmetic (1690), he defined the art of reasoning through figures relevant to the work of the government. McCormick (2009) argues that Petty's social engineering was articulated as a mode of statistical analysis.

During the second half of the 18th century, mercantilism would be severely criticized. Future economic thinkers, those promoters of laissez-faire argued that there really was no difference between domestic and foreign trade. All trade was beneficial to both the merchant and the public. To this, they denied zero sum in international trade relations: the amount of money or resources that a state needed would be adjusted automatically.

PHISIOCRACY

This movement of economic thinkers emerged in France around 1750 and had a relevant impact in subsequent decades, its most relevant thinkers were Francois Quesnay (1694-1774), Anne Robert Turgot (1727-1781), and the Marquis Nicolas Condorcet (1743-1794). They argued that the economy flowed in the same sense as natural moral laws. Physiocrats believed that government policies should not interfere with natural economic laws: the natural order allows coexistence in society because justice is common to all human beings and is derived from nature.

In the thirteenth century, Thomas Aquinas developed the idea that reason, common to all, is the basis for understanding the law of nature, which is nothing other than the participation of the eternal law in the rational creature: rational creatures have a natural inclination to understand eternal reason (Lott 2016). In the seventeenth century, John Locke described the state of nature as a state where man conceived of natural law as natural rights expressed in life, liberty, and property.

Likewise, Physiocrats affirmed that economic theory is based on natural law, which governed the operation of the economy through the independence of human will. Natural law and the functioning of the economy are independent of human will, and could be discovered objectively. The Physiocrats realized that economic laws are innate insofar as they are deduced from the principles of knowledge (Neill 1949). Economy is nothing more than the application of the natural order to the government of society.

They proposed that the origin of wealth was agriculture, underestimating the added value of manufacturing. They attacked mercantilism not only because of its large number of economic regulation. While the mercantilists held that each nation should regulate commerce and manufacturing to increase its wealth and power, the Physiocrats held that labor and commerce should be freed from all restrictions. Also, while the mercantilists asserted that coins were the essence of wealth, the Physiocrats asserted that wealth consisted of the products of the soil.

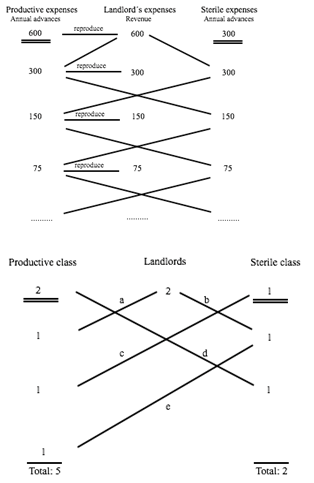

Quesnay's Tableau Economique attempted to show how an entire economy works, a geometric representation of the sources and circulation of wealth and the flows of goods. This will inspire Adam Smith to theorize about the division of labor (Mattelart 2007). The landlord receives the rent of the land, which he spends on products from artisans and farmers. Artisans (sterile class) transform agricultural products into edible products such as using wheat in bread, and by spending their income on inputs and their own subsistence. Finally, the farmer, after spending on inputs, generates a surplus that is delivered in the form of income.

Physiocrats lay out the basic natural principles of economics in two ideas: people want to maximize their profits; and, the prices are freely adjusted in the market depending on the need. These principles were understood in the reduction of production costs, leaving wages at low levels (Landreth and Colander 2006). Although they did not present a coherent theory of prices and their relation to the market, they emphatically affirmed that a society improves as long as its individuals are carried away by their own interests, and that free competition would improve market prices.

ADAM SMITH

Adam Smith (1723-1790) is perhaps the most prominent thinker in the history of economic thought, especially for the theory of the invisible hand. He was born in Scotland, at the age of fifteen, he began studying moral philosophy at the University of Glasgow, and at the age of seventeen he entered Balliol College, Oxford. In the 1950s, Smith published short essays that lead him to write his magnificent work Inquiry into the Nature and Causes of the Wealth of Nations. In 1759, he published his Theory of Moral Sentiments, based on the usefulness of sympathy. His most important contributions are on moral and political philosophy.

Smith takes an in-depth look at the relationship between the economy and freedom as an intertwined sustenance for development. He takes into account the constant adjustments between freedom and control, continuity and change, and hierarchy and equality (Samuel 1977). These elements are based on the requirement of a systematic handling of freedom in relation to the principles of civilization. Adam Smith (1977 1776) argued about market restrictions as a limitation for freedom and, therefore, for development, restrictions are to be found in the same market.

Market freedom would enter into an appropriate game as long as there is a significant number of buyers such as a significant number of sellers, the free market as the representation of high competition between sellers and buyers. Smith was against monopolies, as well as against state intervention: the first, because the price in monopoly markets is always the highest that can be achieved; the second, because it can create overabundance when there is a minimum price, or it can create scarcity when a maximum price is imposed.

Smith was concerned with studying the relationship between the protection of private property and a just state. In his argumentation on natural law, he considered property of work as the just result of effort, that is, property of work as the fundamental right on which all other more developed property rights are based (Gronow 2015). The property that each man has in his own work is the philosophical basis for all other properties, and is therefore the most sacred and inviolable. The work is only the last standard to establish the price of the products, the real price is the work, while the nominal price is represented in money.

The voluntary transactions within the mutual agreement deserves respect and protection because it becomes the image of a state that seeks justice. Thus, justice is found in the protection of labor property and, by extension, in the protection of private property (Johnson 1990). Negotiation is the basis for maximizing salary fairly for both parties as it represents the relationship between individual interests.

Smith argued that the free market is the place for the emergence of self-interest, which would promote greater prosperity. The natural tendency of humans towards self-interest would create spaces of prosperity that would benefit the whole of society. Hence, Smith explored the balance between economic individualism and social morality in his Moral Theory of Feelings, in which he emphasized that self-control and prudence can be degraded in the market that is strongly impersonal, then, the limits of the market depend on other modes of social interaction. Smith

paid a great deal of attention to a flourishing society’s dependence on virtues, including the non-self-regarding virtues of justice and benevolence, and he worried also about their fragility in the face of the changed incentives and social conditions of commercial society. (Graafland and Well 2021:31)

The passions that are identified in individuals as selfish interests can be considered as legitimate elements that appear a priori in any market relationship, until they go through the complex process of social adaptation. Social and political interactions create limits for the functioning of the market in response to the dangers, deviations or threats. Also, laws can shape and promote certain desirable forms of behavior, at the same time he recognized that even the most common degrees of goodness or beneficence cannot be imposed by force (Smith 1984).

Regarding employment and wages, Smith argued that when an entrepreneur tries to establish a new business, he must first attract workers from other jobs by offering higher wages compared to other companies or compared to his own trades. However, these new industries can more easily enter scenarios of instability and bankruptcy. Labor wages are likely to be higher in manufacturing industries based on fashion or artificial needs than in manufacturing industries based on basic needs, and yet they are weaker over time (Smith 1984) as these created needs change rapidly.

The accusations to Adam Smith about individualism are weak as the basis for individual interests are possible as long as the interests of society are pursued at the same time. Individuals who take care of their own, as well as their environment, can generate enormous benefits for the nation. As Newbert (2003) suggests, the art of protecting individual interests comes hand in hand with social welfare, contemporary entrepreneurs not only seek to satisfy their selfish motivations, but also seek to contribute substantially to the well-being of society.

(Otteson 2018:14). Smith's contributions became the political and economic foundation of a large part of Western societies.“when Smith claims we all desire mutual sympathy of sentiments, he means that we long to see our own judgments and sentiments echoed in others”

THOMAS MALTHUS

Thomas Robert Malthus (1766-1834), English economist, educated at home until his admission to Jesus College Cambridge in 1784, graduated in 1788 and completed his master's degree in 1791. He received his reverend degree in 1897. His father, Daniel Malthus, was a well-known thinker, a friend of David Hume and Jean Jacques Rousseau. It is presumed that conversations with his son influenced his intellectual development (Pavlik, 2016). In 1805, he was chosen as professor of history and political economy at East India College in Haileybury. In 1819, he was elected as a member of the Royal Society.

Malthus argued that the population tends to grow at a faster rate than the supply of food, the growth of the population had no limits and was repressed by death. Habakkuk (1959) believed that a part of this thesis may well have been influenced by Darwin's theories on the power of reproduction. The novelty of the thesis was its presentation based on three elements: first, the population pressure on food production; second, growing poverty; third, misery was the product of social and political institutions. Malthus lived within anxiety “by worrying about overpopulation, rather than overspending” (Weber 2021: 409) as other thinkers of the same century.

His theory on population pressure and food production was the result of an increase in English food imports at the end of the 18th century that tried to supply the growing demand. Malthus proposed that food is the first basic need of the human being and that, at the same time, sexual passion would not disappear, but would increase as the population increases. In the absence of any birth control, in his essay On the Population Principle he concluded that the population growth rate is higher than the growth rate of food as population expansion cannot be kept under a strong control.

On growing poverty, he believed that the main cause of indigence is the difference between population growth and food growth: food production is not fast enough to supply population growth, which it would inevitably lead to an increase in poverty. The difficulty of acquiring food would increase over time, generating a clear problem in the despair reflected in various forms of misery. Therefore, it was essential to implement artificial birth controls such as the postponement of the marriage.

Nonetheless, his theory did not stand since it did not offer any evidence about the growth rate of population or food, or any statistical approximation to it. In addition to this, he left aside the theory of the principles of diminishing returns proposed by Turgot in 1765, who stated that the fixed factor of production was land, which did not change substantially over time, while other factors of production such as investment and work can increase. Several decades after his death, certain criticisms appeared about his lack of regard for the impact of technology on the production of agricultural goods and on birth control.

Finally, the controversy with his father revolved around the genesis of misery and poverty, Malthus criticized the thesis of his father, and his close friend, Jean-Jaques Rousseau, on the future of nations. Daniel Malthus, his father, believed that the future will be full of prosperity, with fairness and perfect happiness, as long as the human being frees himself from the limitations of custom and institutions (Habakkuk 1959). On the contrary, Thomas Malthus argued that hopes of social happiness are vain because population will always tend to outpace production growth, creating war, poverty, famine and abstinence: human being was condemned to misery.

The Malthusian model can be seen as a prediction of possible repercussions in the absence of continuous technological improvements and in the absence of birth controls. Despite subsequent criticism, his model was influential in Europe and America until the beginning of the industrial revolution, a period that generated evidence contrary to the predictions made. On the other hand, it is clear that, in many countries with increasing income levels, demographic rates are constantly decreasing, which has produced economic problems in social security systems. Finally, Weil and Wilde (2010) believe that reductions in population growth increase per capita income.

DAVID RICARDO

David Ricardo (1772-1823), English economist who gave a classical and systematized shape to the nascent economic science of the 19th century. Of Sephardic Jewish descent, he was the third son of a wealthy family who had migrated from Spain to Italy, then to the Netherlands, from where they left for England. His grandfather, Joseph Israel Ricardo, worked at the Amsterdam Stock Exchange, his steps were followed by his son and then by his grandson, Abraham Israel Ricardo and David Ricardo (Read 2016). When they moved to London in 1760, David Ricardo went into business with his father, creating the name of a very wealthy family. In 1810, he published his book The High Prices of Bullion; however, his main work, Principles of Economic and Tax Policy, was published in 1817.

Ricardo made several important advances in theories of value, international trade, diminishing returns, and income. Ricardo's theory of value attempts to answer the controversy in England over grain import tariffs. While Malthus argued in favor of the creation of import tariffs, Ricardo believed that these would reduce profits, which would impact economic growth: when tariffs increase, the need to produce more to cover the unsatisfied demand also increases causing an increase in wages, in addition to the overuse of land, meaning capital to decrease.

While the protectionists refuted Ricardo, and supported the Grain Law, arguing that the elimination of import tariffs would cause the prices of products and wages to fall, David Ricardo was forced to propose a theory of value. In his book Principles of Economic and Tax Policy, and later in the essay Absolute Value and Exchange Value, he mentioned that the value of a product depends on the relative amount of work to arrive at the final product and not on the salary that is pays for its production. Thus, the value of a good depends on the existing demand, based on scarcity, and the total amount of work required to produce the good (Landreth and Colander 2006).

Ricardo's labor theory of value attempted to explain why goods were exchanged for prices that fluctuated in the market, he claimed that the value of a product could be objectively determined by the average number of hours of labor required to produce it, this value being the value of work, the main source for measuring the value of a good. Ricardo was interested in the relative prices of basic products of which he would say that the cost of production involves direct and indirect costs. It is clear to Ricardo that the relative price of products is determined by demand and by the total work required for production (Johnson 1984).

As an example of comparative advantage, Ricardo wrote:

The quantity of wine which she [Portugal] shall give in exchange for the cloth of England, is not determined by the respective quantities of labour devoted to the production of each, as it would be, if both commodities were manufactured in England, or both in Portugal. England may be so circumstanced, that to produce the cloth may require the labour of 100 men for one year. (Bernhofen and Brown 2018:227)

On international trade, Ricardo is well known for his theory of comparative advantages, by which he showed that specialization in the production and export of specific goods contributes more to the economic development of a nation than diversification in production. Specialization in the manufacture of a good contributes to the decrease in the relative cost of this product, which makes its commercialization even more competitive (Maneschi 1992). Ricardo admitted that no country is absolutely more competitive than another; however, specialization in the production of a good will enable countries to increase their comparative advantage.

For Ricardo, the comparative advantages are given by the differences in technology, the differences in the acquisition and commercialization of primary goods, the difference in demand, the difference in the existence of economies of scale in production, and finally by the existence of government policies that favor the production of goods and services. These elements will intervene in the decision of nations about the products to be produced and marketed, the impact of these decisions will influence the economic development of the countries.

Ricardo's theory of comparative advantages would be criticized decades later by various economists and social thinkers because the countries that export raw materials have not succeeded in creating competitive manufacturing companies in relation to other regions of the world. For example, Latin America were dedicated to the export of primary goods and that did not achieve the impulse or advancement of the manufacturing. In 1950, Raúl Prebisch argued that the prices of manufactured products would rise while the prices of primary products would remain or fall, producing a problem in the terms of trade.

On the other hand, about diminishing returns, as Rogelio Huerta (2001) wrote, citing Samuelson and Nordhaus, there are the fixed cost factors and the variable cost factors, when the latter increases in a short time will result in a smaller and smaller production increase because the fixed cost factors remain the same. Thus, labor is the variable factor most used to increase production. However, in the long term all the factors of production can be variable including capital such as land. In this case, production is not limited by the law of diminishing returns, but, on the contrary, it can increase each time at higher rates.

The Ricardian presents a way of mitigating the effects of diminishing returns. In the long run, if one takes into account that all the factors of production become variable, the problem dissolves because returns increase as variables such as capital and land grow with investment. However, in the short term, Ricardo believed that it can be solved through free international trade (Rent 2018), which allows a country to specialize in the production of certain goods, while importing the goods in those that are less productive.

Regarding income, although it was not Ricardo who started the studies of land rent, it was the one who tried to construct determinants and principles of political economy to understand its three main sources: land, labor and capital (Rent 2018). In relation to land, Ricardo's formulation is the one that found the greatest impact in academia and in the practice of economics because he carried out a deeper and more real theoretical approach to rent. Thus, this did not only mean the contract of payment to the landlords, but included total productivity minus the rental contract, less wages and capital.

The rent of the land was related to the price of agricultural products. The price of an agricultural product would be determined by the cost of the least fruitful unit produced that satisfies the demand, that is, it would be agreed around the marginal cost (Márquez and Silva 2008). Ricardo recognized that, when speaking of land rent, an important element was the fertility of the land, the more fertile the more productive it was, and the less fertile the land the less productive it was. Then the price would be determined by the marginal cost of the least efficient land.

Ricardo was a prominent economist, but also a politician, a member of the Parliament of Great Britain, and very successful in his business endeavors, as well as on the Stock Exchange. He died at a young age, 51, from a brain infection. After his death, the impact he had on academia, on commerce, finance, the economy, and the stock market, served to found the main European schools of economics of the 19th century. Ricardo is considered the second most influential economic thinker in the eighteenth century after Adam Smith.

CONCLUSIONS

The long eighteenth century, led by Great Britain, the nation with the greatest importance and impact in the West, was imposed by technological transformations, agricultural advances, commercial and banking expansion. Within this context, thinkers appear who become the most relevant western economic theorists. The principles of classical liberal thought are found in this century, namely: the mercantilists, the Physiocrats, then the classical thinkers like Adam Smith, Thomas Malthus, and David Ricardo. Although they all share the idea that the forces of the economy can be understood rationally, there were also important differences that made them confront each other on an ongoing basis.

The problem of the article was the systematic revision of the development of the economic thought in order to appreciate the similitudes and differences and the objective was to present the arguments as the foundation of a Modernity characterized by the economic. In this sense, the following are the main conclusions:

First. The differences were clear: while the thinkers of mercantilism opposed international free trade for the conviction that some won and others lost, considering wealth as static, with no option to increase, on the other hand, the Physiocrats, plus Adam Smith and David Ricardo, were convinced that all nations won in trade. Another clear difference was the demographic impact, while Thomas Malthus believed that the increase in population would bring misery, Adam Smith and David Ricardo believed that the population increase came hand in hand with economic development.

Second. The most interesting element of this century was the conception of natural law seen in principle as a moral law, but seen by economic thinkers as natural laws that could be analyzed through logic and human nature, in a kind of rational and coherent science. The economy developed through natural laws based on the rational idea that human beings always want the best benefit, in the case of buyers, good products at a lower price, and in the case of producers, lower costs and higher profits.

Third. The Century of Light, full of technological and demographic changes, and full of political, social and economic thinkers, is not a period of a homogeneous current, but, on the contrary, is full of arguments, against arguments, ideological battles and academic impacts. Despite this, they have a clear common line, the idea that economics can be analyzed through logic and human nature, in a kind of rational and coherent science. This economic rationality will be questioned in later centuries.