Introduction

International Financial Reporting Standards (IFRS) were introduced in 2005 in 150 countries as mandatory accounting standards for publicly listed companies. They improve corporate governance mechanisms, promote transparent, quality, and comparable financial information that can help lower uncertainty, cost of capital, and increase investment and growth (Fortin et al., 2010).

This paper examines IFRS mandatory adoption and the properties of accounting earnings (income smoothing, asymmetric timeliness, and accrual aggressiveness) as measures of earnings quality in Ecuador using a difference-in-difference framework for 5.436 firm-year observations during 2009-2011. The change in recognition and measurement practices originated by IFRS adoption is reflected in earnings properties, constituting an important channel of improvement in market outcomes (cost of capital, liquidity, investment efficiency, growth, etc.). Research has been done on changes in accounting quality following mandatory introduction of IFR, mainly in EU-listed firms that adopted IFRS in 2005, either in a cross-country context or within a single EU jurisdiction.1 Recent literature analyzed emerging economies, including Latin American countries.2 The choice of Ecuador offers two extensions to the extant evidence.

Firstly, the institutional context is very different from the EU, with important implications for the effect of mandatory implementation. The literature suggests that heterogeneity in the institutional environment and firm-specific incentives, affect the characteristics of financial information. Accounting quality is higher where the demand for public information is high. In countries with a strong legal environment and enforcement mechanisms where the primary source of funding is capital markets, firms respond to capital market demand by being large, listed, diversified, leveraged, and internationalized, with high growth prospects and external financing needs. Financial information is important in this type of environment. Companies face pressure to manage earnings in a way that meets market expectations and secures higher valuation. By contrast, Ecuador has underdeveloped capital markets, bank corporate funding, weak legal enforcement, a high concentration of family ownership, and financial reporting that mainly responds to tax pressures. Market development is higher in capital markets within the EU than in emerging countries, questioning the external validity of evidence from the EU. The effect of change in accounting standards on reporting outcomes may depend on the interaction with other institutional features (Hail et al., 2010), and with firm-specific incentives (Isidro and Raonic, 2012). Exploring this dynamic in Ecuador can shed light on the consequences of IFRS adoption in other settings.

Secondly, Ecuador introduced IFRS in 2010 for listed companies and auditing companies; in 2011 for large companies, and in 2012 for all other companies. The staggered adoption allows the use of a difference-in-difference approach, comparing the treatment group that adopted IFRS in 2010 with the control group that adopted IFRS two years later. Thus, we are able to isolate the IFRS effect and safely ignore institutional changes concurrent with adoption, unless they affect the treatment and control group differentially. The IFRS cross-country and single country literature uses information from large databases combined with information provided only for publicly listed companies, rendering impossible within-country comparison of financial information outcomes following IFRS adoption. Several papers on IFRS and earnings quality in Latin America also rely on large databases, employing weaker event study-before and after-research designs (Cardona Montoya et al., 2019, Lopez et al., 2020, and Eiler et al., 2021).

We use financial statements obtained from the Superintendency of Companies (Superintendencia de Compañias) which oversees the financial accounts of all registered firms. We estimate the change in income smoothing, timeliness of loss recognition, and accrual aggressiveness as coefficients from the adapted Ball and Shivakumar (2005 and 2006) accrual estimation model, linking accruals to cash flows in a difference-in-difference framework, exploiting the heterogeneity in adoption time.3 We find accrual levels decrease by 3 percentage points due to IFRS implementation, with a less pronounced negative relation between accruals and cash flows, and as a result, timelier loss recognition. The accruals offsetting of cash flows decreases by 45.6 percentage points when cash flows are negative. Both changes are significant at the 10% level. We find no evidence that income smoothing - the magnitude of accrual offsetting of cash flows when cash flows are positive- has changed.

These results are consistent with the notion that IFRS recognition and measurement practices have contributed to the improvement of earnings quality of listed firms, even in the absence of effective enforcement. As the IFRS likely increased reporting flexibility relative to the Ecuadorian standards (Normas Ecuatorianas de Contabilidad, NEC), the results are unlikely to be driven by the constraining effect of the IFRS on earnings management. Rather, these results suggest a timelier recognition of losses found in other studies (e.g. Barth et al., 2008; Christensen et al., 2015). Voluntary adopters may have the biggest incentive to use the new flexibility for more transparent reporting in order to attract outside capital. Because of the prevalence of family-owned firms and the higher importance of debt vs. equity market, higher earnings quality is likely to relate to debtholders’ demand. Results are also consistent with evidence that firm-specific incentives are a more important determinant of financial reporting quality than institutional factors (Isidro and Raonic, 2012).

Background and hypothesis development

Measures of earnings quality

Earnings quality is the capacity of earnings to reflect the firm’s true financial performance. Given that the true economic performance is not observable, empirical proxies have been developed to measure earnings quality. Some of them are based on the relation between earnings and the market value of equity, while others are based on earnings properties. Since the capital market in Ecuador is underdeveloped and illiquid, we focus on earnings properties and follow the literature on the effects of IFRS (Ahmed et al., 2013) using earnings smoothing, timely recognition of losses, and accrual aggressiveness as proxies of earnings quality.

Earnings are less variable than cash flows, making earnings more informative about performance than cash flows (Dechow, 1994). Variable earnings may occur when there is an error in estimating accruals so that they do not map into cash flows. By contrast, smoother earnings may be indicative of earnings management. Firms may want to smooth earnings using accruals to appear less risky, to use accruals to conceal poor current operating performance, or to reduce higher-than-expected current operating performance (Leuz et al., 2003). We follow prior literature by assuming that a larger magnitude of earnings smoothing indicates earnings management and lower earnings smoothing are indicative of higher earnings quality.

The conservatism principle in accounting allows anticipated losses to be recognized earlier than anticipated gains. Commitment to a timelier recognition of losses than gains is an efficient contracting mechanism that reduces moral hazard (Ball and Shivakumar, 2005). It diminishes management incentives to undertake negative NPV projects because losses from such projects are recognized early. It assists in loan pricing ex-ante and triggering quicker imposition of contractual restrictions if debt covenants are violated. Due to higher transparency, the valuation of the company may increase.4 In line with the literature, we assume that timely recognition of losses reflects higher earnings quality.

Management may use accruals to overstate earnings in order to achieve bonus targets, avoid debt covenant violations, meet earnings expectations, or inflate share prices prior to equity issuance (Palepu et al., 2010). By contrast, incentives to reduce earnings by using accruals include tax incentives and incentives to create reserves for the future. The literature assumes that the incentives to inflate accruals (accrual aggressiveness) are more common, and thus a lower level of accruals suggests higher earnings quality.

Factors affecting accounting quality

Earnings quality is a result of interactions between a firm´s reporting incentives, affected by wider institutional factors (Hail et al., 2010) such as IFRS and other reporting standards. Leuz et al. (2003) find that earnings management is lower in economies with large equity markets, dispersed ownership, strong investor rights, and strong legal enforcement, while Burgstahler et al. (2006) show that it is higher when financial reporting and tax rules are closely aligned. Bushman and Piotroski (2006) show that losses are recognized more timely in code-law countries with strong investor protection, a high-quality judicial system, and strong public enforcement. Commitment to long-term transparency and better quality reporting is higher when firms are: large, politically visible; with frequent debt or equity issuance; with greater needs for outside financings; with higher leverage as a monitoring mechanism, and with higher auditor quality (Isidro and Raonic, 2012; Lang et al., 2006). Timely loss recognition is higher in publicly traded firms due to higher demand for conservative accounting (Ball and Shivakumar, 2005).

The effect of IFRS depends on similarity to previous standards. Ball et al. (2003) find that East Asian countries with accounting standards close to the UK, US, and IAS (International Accounting Standards) had lower levels of timely recognition of losses due to institutional and firm-reporting incentives. Barth et al. (2008) show that IFRS contributes to higher earnings quality by restricting alternatives for earnings management. By contrast, Ahmed et al. (2013) find an increase in income smoothing and accrual aggressiveness and a decrease in timely loss recognition for mandatory adopters in countries with strong enforcement regimes. Christensen et al. (2015) find similar evidence for Germany.

Ecuadorean institutional background

Ecuador is a code-law country with a low rule of law (Kaufman et al., 2009) and underdeveloped capital markets (Fortin et al., 2010). Capital markets are used for debt security issuance, and trade. In our sample period 2008-2011, debt transactions made around 90% of total transactions in the stock exchanges (Bolsa de Valores Quito, 2010). Ownership concentration is higher than in other Latin American countries: around 60% of large and medium firms have up to three shareholders, while only around 7% have more than 30 shareholders (Muñoz, 2014). Camino-Mogro and Bermudez-Barrezueta (2018) find that around 86% of incorporated entities are family-owned.

Corporations (Sociedades Anónimas) and limited liability companies are mandated to prepare financial statements each year and to submit them to Superintendency of Companies (SC). The SC is in charge of enforcing accounting and auditing standards. External auditing is compulsory for firms with assets higher than $2 million. However, during the first decade of the 2000s enforcement was mostly formal and reactive, with high levels of non-compliance (Worldbank, 2005). Financial reporting is aligned to tax reporting. Where specific tax requirements exist, they have typically taken precedence in application over NEC -depreciation, impairment and provisions- (KPMG, 2009).

In the 1999-2001 period, the Ecuadorean National Federation of Accountants (Federación Nacional de Contadores del Ecuador), issued 27 national accounting standards (Normas Ecuatorianas de Contabilidad, NEC) based on IAS, not updated since 2001 until the start of IFRS implementation.

In 2006, the SC adopted IFRS (Superintendencia de Compañías, 2006), and in 2008 issued a decree clarifying the timetable of its application (Superintendencia de Compañías, 2008):

Firms subject to the Securities Exchange Act (companies that list their stocks or debt securities in Quito or Guayaquil stock exchanges) and auditing companies, from 2010.

Firms with assets larger than $4 million, state companies, companies with mixed ownership (public-private), and branches and subsidiaries of foreign companies, from 2011.

All other companies, from 2012 and with the option to apply IFRS for small and medium enterprises.

Possible impact of IFRS on changes in earnings properties in Ecuador

The Ecuadorean institutional framework suggests an overall low level of earnings quality, with high incentives to smooth earnings and manage earnings downwards for corporation tax purposes. At the same time, firms that list their debt securities on the stock exchange may have incentives to report losses timely. The adoption of IFRS may change reporting practices due to differences to NEC, given environment and firm-reporting incentives. Since the last update of NEC in 2001, the International Accounting Standards Board has amended many IAS and replaced other norms with IFRS, or proposed a number of new IFRS. The new IAS/IFRS leave more room for subjective estimations without providing clear implementation guidance and interpretation.

Therefore, IFRS brings new standards on areas previously non-regulated in Ecuador, but also allows for more discretion in its application. Managers may use the increased discretion either for transparent communication of company information, or to manage earnings with opportunistic goals. Given the initial low quality of earnings, it is unlikely that IFRS would lead to worse accounting quality. Listed companies (the first wave of adopters) may have incentives to commit to higher reporting quality in order to attract better terms of financing through stock exchanges, and separate their financial reporting from tax reporting. These firms are most likely to benefit from the adoption of IFRS, and as the literature suggests, these firms would have been most likely to adopt IFRS voluntarily. Consequently, our hypothesis is as follows:

H1: Earnings quality increases after adoption of IFRS for the first group of adopters.

Research design

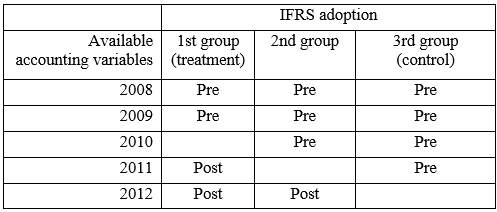

To isolate the effect of IFRS adoption on the earnings properties, we use a difference-in-difference design that uses its staggered implementation and compares outcomes in the period before and after IFRS adoption, in treatment (adopters) and control group (non-adopters). The time comparison -before and after- helps identify the effect of IFRS on outcomes, while the control group isolates the effect of IFRS from the general time-trend and other concurrent factors. The diff-in-diff estimator can be interpreted as the effect of IFRS on earnings quality under the assumption that without adoption, the change in earnings quality time trend would not differ between treatment and control. The design allows for pre-existing differences in outcomes -earnings quality- between treatment and control groups, as long as “parallel trends” would have been observed in the absence of adoption.

Our treatment group consists of firms that adopted IFRS in 2010. We omit that year from the tests because variables are calculated using numbers obtained under IFRS and previous year’s numbers, obtained under NEC. As our sample goes from 2007 to 2012, it is not possible to use information from the second group of adopters. Therefore, we define the treatment group as those firms belonging to the 1st group of adopters (2008 and 2009 as pre-treatment and 2011 as post-treatment period), while the control group consists of firms that adopted the IFRS in 2012. In all cases, data for 2010 is omitted. We present composition of treatment and control groups graphically in Figure 1.

Source: Superintendencia de Compañías, Valores y Seguros.

Figure 1: Composition of sample across years along IFRS adoption dimension

The difference in difference set up does not assume that treatment group firms (listed companies) have the same level of earnings quality as control group firms (all other firms). Through the “parallel trends” assumption, it only requires that the time trend in earnings quality is parallel between groups. The identification strategy would not be valid if changes in the economic environment or policy interventions affect treatment (listed companies) and control group (all other companies) differentially, and at the same time affect earnings quality during the adoption period. Such changes could not be identified through our knowledge and analysis of the institutional and national setting, nor could we identify differences in the rate of change -slope- of earnings quality between groups through time.

Similar difference-in-difference studies on the effect of IFRS on earnings properties use firms from countries that did not adopt IFRS as a control group (Ahmed et al., 2013; Capkun et al., 2016; Hellman et al., 2022). Hail et al. (2010) point out that this makes the analysis susceptible to confounding country-specific effects that could arise because of other concurrent institutional changes and economic shocks. Unlike prior studies, we use a within-country sample of firms with the same reporting requirements, ruling out the possibility that observed changes attributed to IFRS could have happened because of other concurrent events in the country.5

Estimation of earnings quality measures

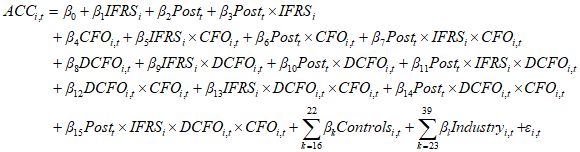

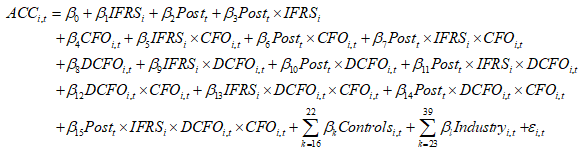

We estimate three properties of earnings quality (earnings smoothing, timely loss recognition and accrual aggressiveness) using a single regression equation. Timely recognition of gains and losses reduces observed earnings smoothing. Failing to control changes in timely gain and loss recognition may lead to wrong inferences about the adoption effect on earnings smoothness (Capkun and Collins, 2018). Our regression model draws from the Ball and Shivakumar (2005 and 2006) model for estimating timely loss recognition in private firms. Capkun and Collins (2018) used it to estimate the effect of IFRS on earnings smoothing and timely loss recognition for firms from 28 countries between 2005 and 2009, but did not employ a diff-in-diff design. The model is augmented with firm-specific incentives from Barth et al. (2008) and firm fundamentals affecting accruals from McNichols (2002). The estimates equation is as follows:

where

ACC is accruals:  Inventories +

Inventories +  Receivables +

Receivables +  Prepayments +

Prepayments +  Other current assets -

Other current assets -  Payables -

Payables -  Income tax payables -

Income tax payables -  Other current liabilities - Depreciation and amortization

Other current liabilities - Depreciation and amortization

CFO is cash flow from operations: Net income - Accruals

DCFO is a dummy variable that equals 1 if CFO<0 and equals 0 otherwise.

IFRS is a dummy variable that equals 1 if the firm-year observation belongs to the treatment group (group 1), and 0 otherwise

Post is a dummy variable that equals 1 if the year is 2011 (IFRS post-adoption year) and 0 otherwise.

Controls is a set of additional time-varying variables to control for the effect of firm fundamentals and firm’s incentives on the level of accruals that may be correlated with adoption.  is a change in revenue; GPPE is gross property, plant and equipment; SIZE is a natural logarithm of total assets; CSISSUE is change in ordinary share capital; LEV is a leverage calculated as total liabilities divided by book value of equity; DISSUE is change in debt calculated as change in total liabilities; BTD is an absolute difference between earnings before taxes and taxable income, where taxable income is approximated as income tax divided by statutory tax rate (25% in 2008 and 2009 and 24% in 2011). LISTED is a dummy variable that equals 1 if a firm has debt securities or shares listed in the stock exchange, and 0 otherwise.

is a change in revenue; GPPE is gross property, plant and equipment; SIZE is a natural logarithm of total assets; CSISSUE is change in ordinary share capital; LEV is a leverage calculated as total liabilities divided by book value of equity; DISSUE is change in debt calculated as change in total liabilities; BTD is an absolute difference between earnings before taxes and taxable income, where taxable income is approximated as income tax divided by statutory tax rate (25% in 2008 and 2009 and 24% in 2011). LISTED is a dummy variable that equals 1 if a firm has debt securities or shares listed in the stock exchange, and 0 otherwise.

Industry is the industry fixed effects based on the aggregate level of National Classification of Activities (Clasificación Nacional de Actividades) CIIU 4.0 (Instituto Nacional de Estadistica y Censos, 2012).

CFO, ACC, , GPPE, CISSUE, DISSUE and BTD are scaled by average total assets. ACC, CFO, CISSUE, DISSUE and BTD are winsorized at -1 and +1, while

, GPPE, CISSUE, DISSUE and BTD are scaled by average total assets. ACC, CFO, CISSUE, DISSUE and BTD are winsorized at -1 and +1, while  , GPPE are winsorized at 1% and 99% level, and LEV at the 99% level, to control for outliers.

, GPPE are winsorized at 1% and 99% level, and LEV at the 99% level, to control for outliers.

We include book-to-tax difference to control for shifting tax-induced incentives of earnings management. Prior to the adoption of IFRS accounting was driven by tax demands, resulting in high book-to-tax conformity. After introduction of IFRS, conformity has increased and financial reporting has been somewhat decoupled from tax reporting. Without controlling for this effect, we may erroneously attribute any change of earnings quality by tax shifting incentives to IFRS adoption. We control for listing status as it is required for IFRS firms to be listed. If firms have self-selected into listing in 2010 in order to implement IFRS, not controlling for listing status may overestimate the effect, otherwise attributable to listing of debt securities or stocks.

Coefficients on CFO represent measures of earnings smoothing. As accruals are expected to covary negatively with accruals (matching principle and potential manipulation), the base coefficient for control group  on CFO is expected to be negative. The coefficient

on CFO is expected to be negative. The coefficient  measures the average difference in smoothing between treatment and control groups in the base year. The coefficient

measures the average difference in smoothing between treatment and control groups in the base year. The coefficient  measures any change in earnings smoothing due to a time-trend, while coefficient

measures any change in earnings smoothing due to a time-trend, while coefficient  measures any change in earnings smoothing incremental to the time-trend and resulting from adoption. If IFRS improves earnings quality, earnings smoothing should be reduced and

measures any change in earnings smoothing incremental to the time-trend and resulting from adoption. If IFRS improves earnings quality, earnings smoothing should be reduced and  should be positive.

should be positive.

Timely loss recognition is measured through coefficients on DCFO x CFO. If economic losses are more likely to be reflected in accounting earnings than economic gains due to conservatism, then the negative association between accruals and cash flows should be smaller. Therefore, the base coefficient for control group  on DCFO x CFO should be positive.

on DCFO x CFO should be positive.  measures the average difference in timely loss recognition between treatment and control group in the base year.

measures the average difference in timely loss recognition between treatment and control group in the base year.  measures any change in timely loss recognition due to time trends, and

measures any change in timely loss recognition due to time trends, and  measures any additional change in timely loss recognition resulting from adoption.

measures any additional change in timely loss recognition resulting from adoption.

Accrual aggressiveness is reflected in coefficients that show variations in the level of accruals. The intercept  measures the average level of accruals of the control group in the base year, controlling for other factors.

measures the average level of accruals of the control group in the base year, controlling for other factors.  measures the average difference in accruals between treatment and control group in the base year.

measures the average difference in accruals between treatment and control group in the base year.  measures any change in accruals due to time trends, and

measures any change in accruals due to time trends, and  measures any change in the level of accruals resulting from IFRS adoption. Increased earnings quality should translate to accruals decrease, so coefficient

measures any change in the level of accruals resulting from IFRS adoption. Increased earnings quality should translate to accruals decrease, so coefficient  should be negative.

should be negative.

The difference-in difference regression approach may not control for all factors correlated with the adoption of IFRS and related to the outcome. Changes in the economic environment or policy interventions that affect treatment (listed companies) and control group (all other companies) differentially and at the same time affect earnings quality during the IFRS adoption period could not be identified through our knowledge and analysis of the institutional and national setting.

Sample and descriptive statistics

Sample

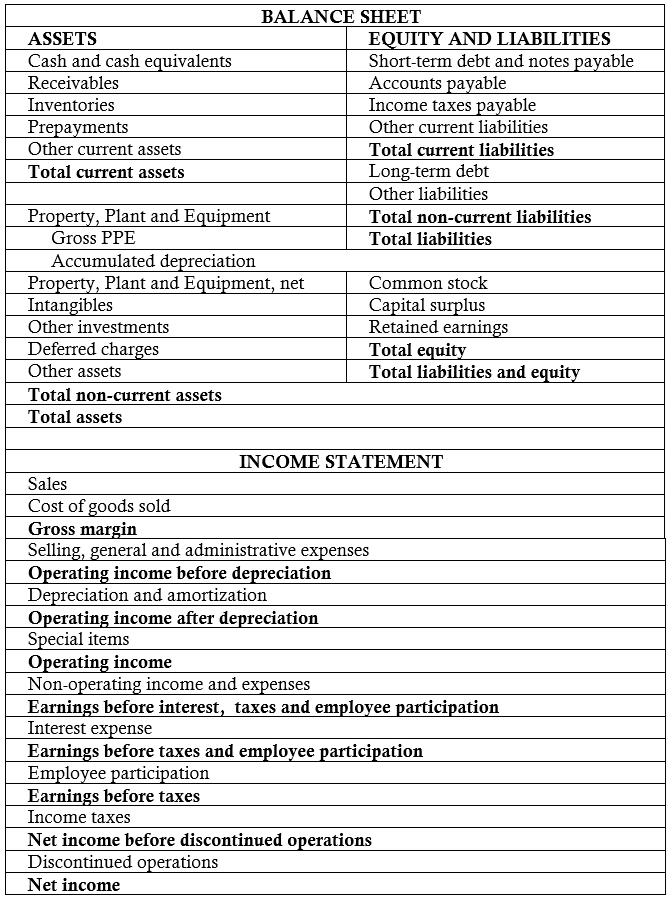

We obtained financial statements data for the years 2007-2012 from the SC. The individual accounts of the balance sheet and the income statement in the pre-IFRS period were coded according to the codes in the corporation´s tax return. In the IFRS period, the SC developed a new coding system to reflect changes introduced by IFRS. We reconcile the two sets of accounts using the Tax Collection Agency manual (Servicio de Rentas Internas, 2012), and aggregate accounts into the standardized format of the income statement and the balance sheet, in Figure 2.

Source: Superintendencia de Compañías, Valores y Seguros.

Figure 2 Standardized formats of Balance Sheet and Income Statement

We eliminate firm-year observations with zero sales, with inconsistencies between aggregate accounts and corresponding sum of the disaggregate accounts, and inactive firms. Firms in the final sample have to have complete information to run model (1) for all of the sample years. We also keep only small, medium, and large companies in the sample - sales larger than $100,000 assets larger than $100,000 and with more than 10 employees-, eliminating “microempresas”. We also eliminate brokerage houses, fund management and all other companies in industry sector “K” which includes financial and insurance firms (Instituto Nacional de Estadistica y Censos, 2012). Table 1 presents information on sample composition.

Table 1 Sample Formation

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEC | NEC | NEC | NEC | IFRS | NEC | IFRS | IFRS | Total | |||

| Initial sample | 47,768 | 52,042 | 53,210 | 49,838 | 361 | 40,439 | 2,834 | 40,987 | 287,479 | ||

| Less:a | -18,273 | -21,048 | -20,855 | -17,201 | -18 | -11,826 | -68 | -10,498 | -99,787 | ||

| 29,495 | 30,994 | 32,355 | 32,637 | 343 | 28,613 | 2,766 | 30,489 | 187,692 | |||

| Lessb | -832 | -197 | -38 | -121 | -1 | -79 | -5 | -22 | -1,295 | ||

| 28,663 | 30,797 | 32,317 | 32,516 | 342 | 28,534 | 2,761 | 30,467 | 186,397 | |||

| Less:c | 0 | 0 | -2,835 | -1,260 | -5 | -776 | -35 | -540 | -5,451 | ||

| 28,663 | 30,797 | 29,482 | 31,256 | 337 | 27,758 | 2,726 | 29,927 | 180,946 | |||

| Less:d | -28,663 | -6,307 | -5,100 | -5,338 | -27 | -4,167 | -1,279 | -7,901 | -58,782 | ||

| 0 | 24,490 | 24,382 | 25,918 | 310 | 23,591 | 1,447 | 22,026 | 122,164 | |||

| Less:e | -11,712 | -17,991 | -17,494 | -149 | -15,496 | -351 | -14,175 | -77,368 | |||

| 12,778 | 6,391 | 8,424 | 161 | 8,095 | 1,096 | 7,851 | 44,796 | ||||

| Less:f | -92 | -42 | -36 | -21 | -32 | -30 | -57 | -310 | |||

| 12,686 | 6,349 | 8,388 | 140 | 8,063 | 1,066 | 7,794 | 44,486 | ||||

| Less:g | -9,385 | -3,048 | -5,191 | -36 | -5,449 | -379 | -4,493 | -27,981 | |||

| Final sample | 3,301 | 3,301 | 3,197 | 104 | 2,614 | 687 | 3,301 | 16,505 | |||

| IFRS adoption groups | Number of Firms | Number of obs. | Used in experimental regression tests | ||||||||

| 1st group | 104 | 520 | 208 | ||||||||

| 2nd group | 583 | 2,915 | |||||||||

| 3rd group | 2,614 | 13,070 | 5,228 | ||||||||

| TOTAL | 3,301 | 16,505 | 5,436 | ||||||||

Notes:

NEC are Normas Ecuatorianas de Contabilidad.

IFRS are International Financial Reporting Standards.

a Observations with sales = 0

b Observations where the difference between codes of total current assets, net PPE, total non-current assets, total assets, total current liabilities, total non-current liabilities, total liabilities, total equity, total equity and liabilities, total revenues, total cost, earnings before tax and employee participation and net income and the sum of their respective components is higher than 5%

c Inactive firms

d Observations without all necessary variables to conduct regression tests

e Observations for micro-firms: sales less than $100,000, total assets less than $100,000 and less than 10 employees

f Observations from firms in financial sector "K" (brokerage houses, fund management, etc.)

g Firms which do not have observations for the entire 2008-2012 period

Source: Superintendencia de Compañías, Valores y Seguros.

The final balanced sample contains 16,505 observations from 3,301 firms. In the models, we use 5,436 observations: 208 from the 1st group (treatment) and 5,228 observations from the 3rd group (control). We use individual non-consolidated financial reports. In the sample period, public prospects of offering of debts and equity securities at stock exchange used non-consolidates reports, which suggests that these reports were the only ones publicly available.

Descriptive statistics

Table 2 presents descriptive statistics for treatment and control groups in pre-adoption (2008 and 2009) and post-adoption years (2011).

Table 2: Means of the variables for the IFRS Treatment Sample and Control Sample in Pre-Adoption and Post-Adoption Years

Notes: ** and * denote statistical significance at the 5% and 10% levels, respectively, for a two-tailed t-statistic test.

Data source for calculating variables: Superintendencia de Compañías, valores y Seguros.

The treatment and control groups are very different. The control group is more profitable, driven mostly by larger cash flows from operations. In the pre-adoption period, between 28% and 31% of firms in both subsamples had negative cash flows. In the post-adoption period, 38% of treated firms had negative cash flows, while this is the case for only 26% of control group firms. Firms in the control group grow faster, are smaller (which is the natural result of the way the adoption timetable for IFRS was designed), and are more leveraged. Naturally, there are a very small number of listed firms in the control group.

Results

Table 3 presents results of our main tests. The first column presents our experimental regression with pre-adoption year 2009 and post-adoption year 2011. The second column presents results from “placebo” control experiment regression tests, where pre-and post-adoption years are 2008 and 2009, respectively. For our estimation to be valid, the coefficients of interest  and

and  should not be statistically significant.

should not be statistically significant.

Table 3 The impact of IFRS on measures of earnings quality

Notes: ***,**,** denote statistical significance at the 1%, 5% and 10% levels, respectively, for a two-tailed t-statistic test using White heteroskedasticity robust standard errors.

The regression model is as follows:

All variables are defined the section of research design.

Data source for calculating variables: Superintendencia de Compañías, Valores y Seguros.

We observe a high level of income smoothing in the data. The coefficient  on CFO is -0.843, implying that on average 84.3% of cash flows from operations are offset by accruals, for the control group in 2009. In 2009 the treatment group smooths earnings in the same proportion as the control group:

on CFO is -0.843, implying that on average 84.3% of cash flows from operations are offset by accruals, for the control group in 2009. In 2009 the treatment group smooths earnings in the same proportion as the control group:  on IFRS x CFO is not statistically significant.

on IFRS x CFO is not statistically significant.  on POST x CFO is positive but small in magnitude suggesting the marginal decrease in earnings smoothing from 2009 to 2011 for the control group is also small. However, the coefficient of interest

on POST x CFO is positive but small in magnitude suggesting the marginal decrease in earnings smoothing from 2009 to 2011 for the control group is also small. However, the coefficient of interest  on POST x IFRS x CFO is not systematically different from zero suggesting that IFRS did not affect earnings smoothing practices.

on POST x IFRS x CFO is not systematically different from zero suggesting that IFRS did not affect earnings smoothing practices.

Turning to timely loss recognition, firms do not seem to recognize losses in a timelier basis than gains. The coefficient  on DCFO x CFO is not statistically significant. Moreover, the firms that adopted IFRS, seem to smooth earnings even more when cash flows are negative and therefore delay losses:

on DCFO x CFO is not statistically significant. Moreover, the firms that adopted IFRS, seem to smooth earnings even more when cash flows are negative and therefore delay losses:  on IFRS x DCFO x CFO is negative (-0.484). There is also a fall in timely loss recognition between 2009 and 2011 for the control group, since

on IFRS x DCFO x CFO is negative (-0.484). There is also a fall in timely loss recognition between 2009 and 2011 for the control group, since  on Post x DCFO x CFO is negative (-0.127). Nevertheless, the coefficient of interest

on Post x DCFO x CFO is negative (-0.127). Nevertheless, the coefficient of interest  on Post x IFRS x DCFO x CFO is 0.456, significant at 10%. This suggests that adoption contributed to timelier loss recognition and that accruals offsetting of cash flows decrease by 45.6 percentage points when cash flows are negative.

on Post x IFRS x DCFO x CFO is 0.456, significant at 10%. This suggests that adoption contributed to timelier loss recognition and that accruals offsetting of cash flows decrease by 45.6 percentage points when cash flows are negative.

Controlling for other factors, the accrual levels of IFRS adopters are 9 percentage points lower than those for the control group in 2009 (the coefficient  on IFRS is 0.09). The control group´s level of accruals falls by one percentage point during the period 2009 to 2011 (the coefficient

on IFRS is 0.09). The control group´s level of accruals falls by one percentage point during the period 2009 to 2011 (the coefficient  on Post is 0.09). Adoption contributes even more to the decrease in accruals, since

on Post is 0.09). Adoption contributes even more to the decrease in accruals, since  on Post x IFRS is -0.030, suggesting the decrease is equivalent to an additional three percentage points. This coefficient is significant at the 10% level.

on Post x IFRS is -0.030, suggesting the decrease is equivalent to an additional three percentage points. This coefficient is significant at the 10% level.

We find economically important evidence of timelier loss recognition and accrual aggressiveness originating from the introduction of IFRS, but no evidence for income smoothing changes. Our results using different estimation technique corroborate results on asymmetric timeliness found for more developed capital markets in Latin America (Mexico, Chile, Argentina, Brazil and Peru) (Filipin et al., 2012; Jara Bertin and Arias Moya, 2013; Lopez et al., 2020; Rodriguez Garcia et al., 2017). On the other hand, our results are not consistent with Cardona Montoya et al. (2019) and Eiler et al. (2021) who find lower earnings smoothing following the adoption of IFRS for a number of large firms in various Latin American countries and Mexico, respectively.

Column 2 supports the choice of a difference-in-difference approach. If IFRS adoption is the reason for changes in earnings quality, then we should not observe

and

and  to be significant when we estimate the same regression model using 2008 as a “before” period, and 2009 as a “post” IFRS year. The results of Column 2 suggest that the effect of adoption in Column 1 are not capturing different time trends for the control and treatment groups unrelated to IFRS. Indeed, when comparing models in Columns 1 and 2, difference-in-difference coefficients of interest

to be significant when we estimate the same regression model using 2008 as a “before” period, and 2009 as a “post” IFRS year. The results of Column 2 suggest that the effect of adoption in Column 1 are not capturing different time trends for the control and treatment groups unrelated to IFRS. Indeed, when comparing models in Columns 1 and 2, difference-in-difference coefficients of interest

and

and  are not statistically different from zero, while most of the other coefficients are comparable.

are not statistically different from zero, while most of the other coefficients are comparable.

Conclusion

We examine the effect of the mandatory adoption of IFRS on earnings quality in Ecuador. Our sample contains 5,436 firm-year observations. The treated group of firms consists of the first wave of mandated IFRS adopters, mainly listed companies. These companies are likely to benefit from the adoption of the standards because they may be able to signal higher quality earnings and transparent reporting in order to attract better terms of financing through the stock exchange.

We exploit the staggered adoption of IFRS in a difference-in-difference approach, comparing the change in the accounting quality of the first group of adopters pre and post IFRS adoption (2009 and 2011), with accounting quality in the control group -small and medium firms that adopted IFRS in 2012. We operationalize earnings quality through three measures: earnings smoothing, timely recognition of losses, and accrual aggressiveness. IFRS adoption does not seem to be related to changes in earnings smoothing. However, we find economically significant evidence of an effect of adoption on timelier recognition of losses, as predicted by theory. The accruals offsetting of cash flows also decreases by 45.6 percentage points when cash flows are negative. Similarly, accruals decrease by three percentage points after adoption-treated firms. These results are consistent with an improvement in earnings quality, complementing findings from other studies. Our findings are consistent with evidence from Latin America that shows an increase in asymmetric timeliness of loss recognition (Filipin et al., 2012; Jara Bertin and Arias Moya, 2013; Lopez et al., 2020; Rodriguez Garcia et al., 2017) and single country-studies from Australia, UK and China (Chua et al., 2012; Iatridis, 2010; Liu et al., 2011) but not with cross-country studies relying on EU data (Ahmed et al., 2013; Chen et al., 2010). This relates to the idea that mandatory implementation of IFRS improves transparency in settings when it was previously low. Data also shows lower accruals post-IFRS, consistent with incentives to reduce income tax and no evidence of change in income smoothing.

Our research has focused on earnings properties, i.e. the effect of recognition and measurement practices in financial reports. An unresolved issue is whether the improvement in earnings properties actually translates to the improvement of market outcomes, as proponents of IFRS suggest. Freitas de Moura et al. (2020) find that mandatory adoption has reduced cost of debt in 1.4 percentage points in five Latin American countries. Our findings are important because they suggest that improved transparency through timelier loss recognition following IFRS could lower financing cost not only among the biggest firms (as present in de Moura et al., 2020) but also among medium-listed firms in smaller emerging markets, where financial reporting and institutional environment are of low quality. On the other hand, IFRS fixed cost and running cost of implementation may be important (De George et al., 2013; Fox et al, 2013; Higgins et al., 2016), and benefits of IFRS in terms of lower financing cost may not outweigh costs among all firms, and in particular among smaller ones. These issues we leave for future research.