Introduction

In the wake of the Asian tigers and the subprime crisis, the need to incorporate new monetary policy instruments to improve the regulation and supervision of financial intermediaries was put on the table. Those who were supported both by innovation and by the globalization of the financial markets had expanded in an accelerated manner but with inadequate supervision or regulation. This allowed the development of new products and instruments to finance economic activities or to optimally conduct monetary policies.

According to the former presidents of the US Federal Reserve (FED), Alan Greenspan (2010) and Ben Bernanke (2007), the expansion of financial intermediation was a consequence of the excess liquidity whose origin was due to the economy’s growth in the years prior to the crisis. While for the current president of the FED, Jerome H. Powell (2018), the decisions of the Federal Open Market Committee on the interest rate are what has influenced the liquidity of the markets as well as the perception of the risks of sovereign and corporate bonds. Contreras (2009) explains that the excess of confidence experienced after the era of great moderation and low risk aversion was what led financial intermediaries to a scenario of a true plethora of global capital towards the stock markets, encouraging the search of high yields.

This scenario favored a speculative bubble, particularly in the mortgage sector, which increased as the risk aversion incremented in the face of the stock market euphoria or the irrational exuberance to obtain high yields (Greenspan, 2010 and Shiller, 2015). Nevertheless, the risk management mechanisms of the developed economies failed, thus infecting all international financial markets. This failure on a global scale was due to the absence of adequate regulatory mechanisms, as well as the limited information in the risk management systems, for which the financial intermediaries were unable to estimate at which moment the bubble could burst.

Among other factors that influenced the failure of the regulation, is the endurance of the financial intermediaries, who consider it a restriction for markets to operate competitively, since regulation is associated with low levels of competitiveness and economic growth. The authorities’ position was to create mechanisms, such as: Basel II, III agreements, the Dodd-Frank Act, the Volcker rule, among others, to regulate financial intermediaries in the first instance; and procure the necessary conditions for the capital and liquidity requirements to be regulated and adjusted for the risk related to assets (Bernanke, 2013 and Kapur and Mohan, 2014). For Alan Greenspan (2010), the above would limit the possibilities that the financial instruments that circulated in the different financial markets would become toxic or in a debt moratorium, thereby allowing to provide solvency to the banking and non-banking system.

The proposal to regulate and supervise the activities of the financial intermediation is not recent: it has been on the table of discussion before, even after the Second World War where economists Harry Dexter White and John Maynard Keynes discussed a set of proposals that gave origin to the Bretton Woods agreements and the subsequent creation of the International Monetary Fund (IMF). With the IMF, the international financial system experienced relative stability, until the crisis of both the Asian tigers and the subprime highlighted the inability of this organization as a regulator and supervisor. This fact has led to discuss the pertinence of creating a global scheme of regulation that guarantees the healthy development of the activities of the international financial markets.

In this regard, Kenneth Rogoff (1999) discusses how to reform the international financial architecture considering: i) a significant increase in the dependence of the economic cycle between the leading and emerging economies; ii) more integrated financial markets; and iii) increase in the occurrence of crisis or financial instability with greater duration and intensity. So, to reduce the factors of financial instability in the global economy, Rogoff (1985 and 1999) and Eichengreen (1999) raised the need to implement strategies of a global nature aimed at increasing financial regulation and supervision. It is required a monetary policy or international organization that is able to act as a lender of last resort, becoming the regulator and supervisor of international financial markets. Nevertheless, the global economy does not have this figure nowadays, since there is no organization capable of regulating, supervising, or acting as a lender of last resort.

Therefore, the objective of the present work is to demonstrate the importance of coordination among the central banks of Canada, the United States of America (USA) and Mexico, as an instrument to maintain the stability of international financial markets. The present document will consider as hypothesis that the interest rates are the main instruments that are used by the central banks as a mechanism to maintain adequate coordination between them. It is considered that such coordination has been strengthened due to NAFTA. Thus, the monetary policy actions of the countries that constitute the NAFTA area will be studied, during the 2008-2018 period. The relevance of this work is to contribute to the discussion of the pertinence that the central banks coordinate the conduction of their monetary policies to maintain the economic stability of the countries to which they belong. For that, we exemplify the case of central banks that conform NAFTA.

The second section explains how central banks coordinate themselves under the context of monetary-financial globalization seeking to maintain the stability of international markets. In the third section the degree of synchronization between the economies that are part of NAFTA is described, henceforth describing how the banks are coordinated under a leader and follower country scheme. In the fourth section, an autoregressive vector model is used, to prove that the interest rate constitutes the main instrument to coordinate the monetary policy. Finally, general conclusions are presented.

Should central banks be coordinated?

In the globalization of the twenty-first century, economic integration has been consolidated by regions or blocks, implying a greater dependence on the financial-monetary markets between countries. This monetary-financial globalization has led to countries with complete markets or with a greater development being the ones to influence the behavior of capital flows. Meanwhile countries with less developed or incomplete markets become followers or price takers of the former to avoid negative externalities on their economies, especially on their monetary-financial markets.

To reduce the effects of financial instability in the era of globalization in recent decades, central banks must coordinate to maintain market stability. Carlozzi and Taylor (1983), John Taylor (1985) and Rey (2016) explain the previous leader and follower scheme by using reaction functions to describe how the central banks implement their policy through monetary rules. They consider that the agents’ expectations, the international prices of exportable goods, as well as the free flow of capital among countries are key elements for the efficiency and stability of international financial markets (Mohan and Kapur, 2014).

The stability of domestic markets is conditioned to international markets, exchange rate variations, prices of the economy, including wages, as well as the differential of the domestic interest rate with respect to the interest rate of the leading country. This guarantees that the monetary policy decisions of the more developed countries can align the expectations of the less developed countries so that their monetary authorities act in the same direction and thus guarantee the stability of the monetary-financial markets (Powell, 2018). For Mohan and Kapur (2014) and Bernanke (2015), the above is explained through the unconventional monetary policy followed by the FED to get USA economy out of the subprime crisis. This strategy led to the decreasing of the interest rates in emerging countries accompanied with a relative exchange appreciation. However, this scenario was reversed when the FED began to normalize its monetary policy after observing an accelerated increase in the domestic interest rate and the depreciation of local currency against the dollar in the emerging economies (Engel, 2016).

Carlozzi and Taylor (1983) and Taylor (1985) proposed a model of monetary rules to analyze how the central banks of two countries respond to stochastic shocks that may cause repercussions or generate macroeconomic imbalances between the economies, as well as produce a contagion effect between financial markets. This model operates under a scenario of economic integration through trade flows of goods and services with perfect capital mobility and flexible parity. Through this, the monetary rule of the country with the highest development has a bearing on the macroeconomic performance of the least developed country.

The above is because external shocks are considered as relevant externalities, so their frequency and magnitude will cause central banks to coordinate to implement their monetary policy mechanisms to maintain the stability of both the macroeconomic structure and the financial markets between their countries (Rey, 2016; Engel, 2016). According to John Taylor (1985) the monetary authority of the least developed country must use its monetary rule in the same direction as the authority of the country with the highest degree of development since that guarantees the macroeconomic and financial stability of its economy. For Moutot and Vitale (2001) an adequate identification of the shocks that have an impact on the stability of the several economies, will allow an efficient coordination of the central banks in the monetary field. Meyer et al. (2002) mentioned that accelerated and constant changes over the global economy are the factors that have made it difficult for central banks to formalize agreements on future monetary policy actions. To solve this obstacle, Carlberg (2005) proposed a strategy based on the hypothesis of rational expectations to anticipate possible shocks coming from other economies and thus, allowing the monetary authority to adjust its policy strategy.

Moutot et al (2008) adequate coordination among central banks should consider the structure of the economies, particularly on their respective nominal rigidities. The externalities coming from the international markets and the terms of trade are softened or neutralized by the monetary policy of the central bank. Hélène Rey (2016) described the above through the international transmission mechanism in order to explain how the monetary authorities use the credit and risk channels to adjust their economies from external shocks or from the monetary policy decisions of the countries with greater degree of development. For that, she considers the existence of free capital mobility with flexible parity necessary so that central banks may use their interest rate policy to adjust the domestic economy and thus guarantee the stability of prices.

To analyze and study how the monetary authorities use their monetary policy to maintain stability among the economies that maintain trade and capital exchange, Hélène Rey (2016) used the New-Keynesian analytical framework where rational expectations play the backbone to design an optical monetary policy. This policy considers the use of flexible parity as an instrument to isolate external perturbations over the domestic economy. In addition to this, the exchange rate grants enough degrees of freedom to the central bank to determine the interest rate according to the internal conditions of the economy and not due to external factors (Bruno and Shin, 2015). If the domestic interest rate is determined by internal factors, it is a sign that the monetary policy is autonomous and the authority has enough degrees of freedom to achieve the internal policy objectives, as well as to stabilize the product.

The degrees of freedom that the monetary authority gains by using the flexible parity are used to neutralize the changes in international financial conditions on the domestic economy. The case of an external financial imbalance will have a negative effect on the GDP according to the level of the external debt, since it will affect the balance sheet of the central bank and in consequence on the monetary policy (Rey, 2016, Fernández-Albertos, 2015). The exchange rate is adjusted to isolate the imbalances, while reducing the negative effects on the economy.

If this mechanism operates without restrictions, then it will be the indicator that domestic monetary policy is independent, and so the interest rate will be used to maintain the stability of the economy. By maintaining the stability through the adjustment of the exchange rate, and the autonomous determination of the internal interest rate, those mechanisms will allow the financial-commercial integration between countries, as well as the coordination among central banks. According to Engel (2016) the coordination between central banks allows for the optimal conduction of the domestic monetary policy since the authorities have a greater degree of freedom to face the external distortions that could oppose their fundamental objectives, such as price stability.

Fernández-Albertos (2015) indicates the need for the independence of the central bank as the condition of sufficiency to make credible monetary policy among countries that are found in a phase of economic integration and that require monetary coordination. Meanwhile, in Smet (2014) it is mentioned as a requirement both the need for coordination between the monetary and fiscal policy for any central bank to enjoy credibility with transparency and, through this, an optimal interest rates policy can be implemented based on the internal conditions of the economy, thus maintain the stability of both the financial system and the price level.

Descriptive monetary policy analysis of NAFTA zone

To ensure the coordination between central banks, there must be a close link in commercial terms between the economies since this will allow not only their integration in a commercial level but also in the monetary-financial area. In this section, we will describe the type of coordination between the countries that make up the NAFTA2 zone. According to Carlos Salinas de Gortari (2017), former president of Mexico (1988-1994), NAFTA had as its target objective to allow the member countries a greater margin to implement long-term policies that guaranteed for the North America zone an inclusive development with stability. After 25 years of life, NAFTA made the financial markets of the three countries to become codependent on the interrelations of trade flows between the members. Therefore, it is necessary for monetary policy decisions to be coordinated to maintain the stability of North America, thus guaranteeing their integration process in an orderly manner.

Figure 1 shows the evolution of the value of exports among the NAFTA countries from 1994, the year in which it came into existence, until 2018 when its renegotiation was announced by the USA government. It can be seen in panel D that the flow of exports in 1994 goes from around 300 billion US dollars to 1.1 billion US dollars in 2018. These increased approximately 3.5 times in the previous 25 years. In other panels, the tendency of exports is similar in the three countries and most of these are directed to the US market (panel A) indicating that integration focuses on the leading economy. On the other hand, trade between Canada and Mexico is low (panels B and C), because these economies have not taken advantage of the trade agreement to increase their integration, therefore their economic activity depends on USA.

Source: Authors´ elaboration with data from INEGI and OEC.

Figure 1 Exports value in NAFTA Zone. (Billion US dollars)

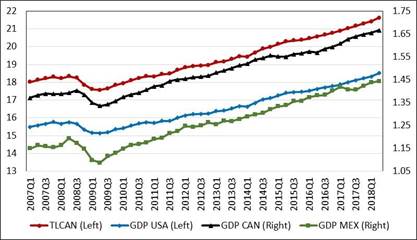

Another way to observe the commercial integration between these countries is through the gross domestic product (GDP), shown in Figure 2 where the product value of the NAFTA zone is around 21 billion US dollars at the end of 2017. The GDP of the three countries has the same trajectory, USA being the one that leads the evolution of the product value of the NAFTA zone, confirming that the economy of the USA is the leader, and, so, the other two are the followers and dependents. It is worth mentioning that the product between Canada and Mexico are similar in value, and inferior to the GDP in USA, which was around 16.5 billion US dollars.

Source: Authors´ elaboration with data from Bureau Economics of USA; Statistics´ Canada and INEGI.

Figure 2 Evolution of GDP in the NAFTA Zone. (Billion US dollars)

With the information of both the Figures 1 and 2 it is confirmed what was said in the previous section where it was mentioned that economies are integrated around the leading economy (USA) and that this one influenced the follower economies (Canada and Mexico) not only on a commercial level but also regarding their monetary-financial markets3. To confirm this, the behavior of the financial sector is analyzed below.

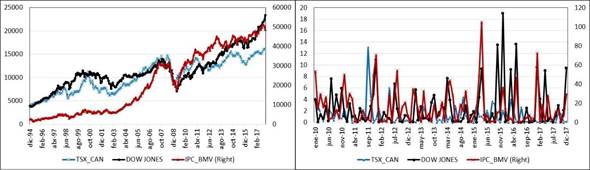

From panel A of Figure 3, we show the long-term trend of the three most representative stock indices of the countries that conform NAFTA: Toronto Stock Exchange (TSX_CAN); Dow Jones Composite Average (DOW JONES); and the Indice de Precios y Cotizaciones of the Mexican Stock Exchange (IPC BMV). Through panel A, it is possible to affirm that after NAFTA came into force, the three stock markets have evolved in the same direction as observed in export flows, that is, they have moved towards an integration surrounding USA financial market. On the other hand, from panel B it is shown the variations of the stock markets -measured by their variance- move in the same direction as the Dow Jones, that is, the response to any shock that affects the stock index of the leading country will have a direct impact on the follower countries.

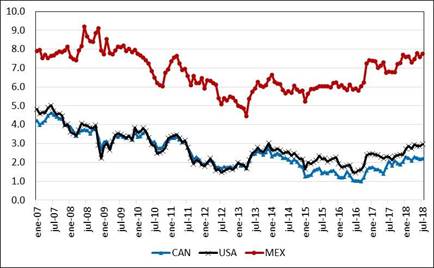

Another way to prove that the economies of Canada and Mexico depend on USA, is through the behavior of government bonds. In Figure 4 it is shown that for the period from 2009 to 2013, which coincides with the FED's unconventional monetary policy, the return of Canada's bonds and USA bonds, performed along. Nevertheless, when the FED started with the normalization of its monetary policy, the USA bonds were separated from Canadians by performing higher returns.

Regarding Mexico's bond, the differential between this one and USA bond, as of July 2018, was around 480 basis points. This was because Mexico, as an emerging economy whose markets are undeveloped, must pay a premium because of being a high-risk country, which is due to a weak fiscal structure, a high level of public debt, corruption, an inefficient political system, among others. Figure 4 shows that the Canadian and USA bond markets present a greater association under symmetrical conditions, while Mexico’s market, as an emerging country with a weak internal economic structure, is the one that presents a greater dependence on shocks coming from external markets.

Source: Authors´ elaboration with data from Bank of Canada, FED and Banxico.

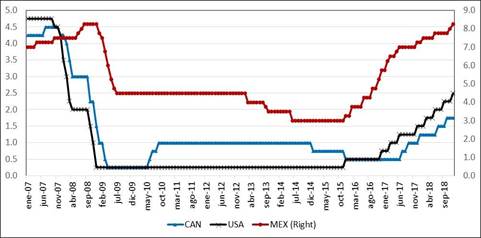

Figure 5 NAFTA Zone: Interest rate of monetary policy

On the other hand, the behavior of public debt bonds is closely correlated with the monetary policies of central banks. In this sense, Figure 5 shows the performance of the target interest rate determined by the central banks that conform the NAFTA zone. In the case of the target interest rate in Mexico, its central bank (Banco de Mexico or Banxico) increases it by following the monetary policy defined by the FED (FED). If the FED’s posture is restrictive, Banxico will increase its target interest rate to maintain the Mexican bond differential with respect to USA and thus avoid a capital flight from the Mexican economy that can cause internal distortions such as volatility in the exchange rate (See Figures 4 and 5).

In the case of Canada, in Figure 5, the monetary policy decisions of the Bank of Canada have shown some independence from the actions of the FED. This confirms what was mentioned in the previous section, when the economies are symmetrical, the decision to raise or reduce the target interest rate is due to domestic factors, so that monetary policy can be considered autonomous or independent. This is the case of the Bank of Canada against the FED.

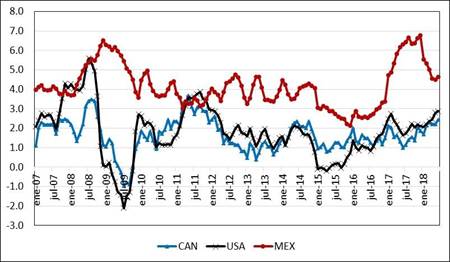

In relation to the trajectory of inflation in the NAFTA area, this is shown in Figure 6. Inflation rates in Canada and USA are synchronized because these economies are symmetric. For this reason, the decisions of the Bank of Canada to modify the target interest rate (see Figure 5) does not completely follow the FED. This confirms that the Canadian monetary policy is independent and is supported by the internal conditions of the Canadian economy.

Source: Authors´ elaboration with data from Bank of Canada, FED and Banxico.

Figure 6 NAFTA Zone: Evolution of Inflation rate

On the other hand, the inflation rate of the Mexican economy is the highest of the three countries that conform NAFTA, in addition to not being synchronized with its trading partners. The lack of synchronization is observed in several periods, particularly in 2017, when inflation in Canada and USA was declining while in Mexico it increased significantly. The above reflects the high asymmetry of the Mexican economy with respect to the Canadian and USA economies. This implies that the monetary policy of Banxico is characterized by following, in most cases, the FED and to a lesser extent by internal factors of the Mexican economy. This implies that the variations of the target interest rate are modified following the FED to maintain the interest rate differential between Mexico and USA (Figures 4 and 5).

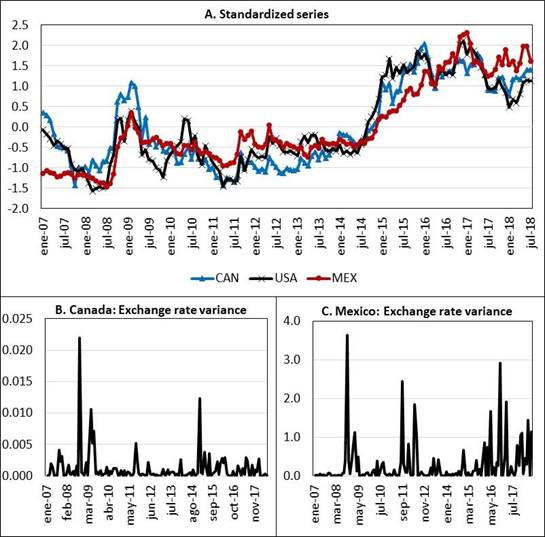

According to previous sections, the exchange rate of the follower countries (Canada and Mexico) is the variable whose role is the escape valve that has the economies open to external shocks. Figure 7 shows through panel A, the normalized series of USA dollar index, the exchange rate of Canada and Mexico with respect to USA dollar. In panel C, the Mexican peso is the one with the highest volatility, which strengthens what was previously said, that the Mexican economy is the one with a high asymmetry. Then, if its economic structure as well as its domestic markets do not achieve a certain level of development, the parity between the peso and USA dollar will continue with high volatility, and the monetary policy of Banxico will follow that of the FED. In panel B, the exchange rate parity between Canada and USA presents low volatility allowing the Canadian monetary policy to be implemented by internal factors and not following the FED.

Source: Authors´ elaboration with data from Bank of Canada and Banxico.

Figure 7 Exchange rate parity of Canada, Mexico, and USA dollar index

With the previous descriptive analysis, it can be affirmed that the countries that conform NAFTA are in an integration process around the leading country or with the highest degree of development. This means that USA is the leader, while Canada and Mexico are the followers. In the case of the Canadian and USA economies, they are the ones that present a greater synchronization due to its symmetrical structure. Hence, its monetary policy is driven by internal factors and not by external shocks. Meanwhile, in the case of Mexico, it is the country with the least development due to its asymmetry economic structure with respect to its commercial partners. This is reflected on the key variables of monetary policy, which depend more on the decisions of the leading country and, to a lesser extent, on internal factors.

Empirical analysis

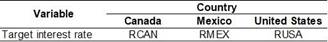

The above considerations allow to establish the hypothesis about the existence of coordination among the central banks that conform the NAFTA zone, which is carried out to maintain the stability of the region's monetary-financial markets, favoring the free flow of goods and services, as well as capital. An empirical analysis is performed in this section to describe such coordination. For this, the period from the first quarter of 2008 to the fourth quarter of 2018 is taken into consideration4. The data sets referred to the target interest rates, were obtained from Bank of Canada, FED, and Banco de Mexico. In a first analysis, a Granger causality test is used to determine the causal direction between the variables considered key to the monetary policy of temporal sense, which are defined in Table 1.

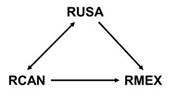

For the Granger causality test, quarterly data was used, and 1 to 4 lags were applied, the results are shown int Table 2. Results are summarized in Diagram 1, the existence of a one-way relationship between RUSA towards RMEX and RCAN towards RMEX is appreciated. While there is a two-way relationship between RUSA and RCAN. The above validates results from previous sections.

The Mexican economy´s monetary policy, being the country with the least degree of development, with respect to its trading partners Canada and USA, is determined by the actions previously taken by the FED and the Central Bank of Canada. While the monetary policies of the Canadian and USA economies are conducted interdependently.

Source: Authors´ elaboration according to the Granger causality test.

Diagram 1 Causal relationship among RUSA with RCAN and RMEX

Based on this temporal causal relationship, it is possible to affirm that the monetary-financial integration between the countries that conform the NAFTA zone has led the central banks of Canada and Mexico to make their decisions following the monetary policy actions of the FED.

To prove the above a VAR model is used to determine if the central bank’s interest rates of Canada and Mexico follow those of the USA. This is made taking into consideration in the work of Taylor (2013), who considers that coordination among central banks consists in following the monetary policy of the USA (leader country), since this one generates economic positive effects in the other countries. Hence, the target interest rate is used to reduce exchange rate volatility, keeps the output and prices stable, as well as to exercise control over the capital flows of the follower economies. On the other hand, Rey (2016), points out that the market’s stability is a condition for the free flow of capital. To guarantee it in periods of instability, less developed countries must follow in the same direction the actions of the central bank of the economy with the highest degree of development. For this purpose, the interest rate is taken as a beacon, since this variable allows the transmission of the monetary policy of the leading country to the followers. Poutineau and Vermandel (2018) indicate that coordination is carried out through interest rates, as these allow the transmission of monetary policy between countries that maintain a close relationship of trade exchange and capital flows. Meanwhile, Clarida (2018) argues that the variations in interest rates allow coordination between central banks and keeps the economies stable in the presence of shocks that negatively affect the exchange rate and inflation rate.

In other words, the interest rate is the policy instrument that is used by central banks to coordinate and adjust economies to shocks that can put economic financial stability at risk. In addition, the methodology of Sims (1986), Galán and Venegas-Martinez (2013) and Walsh (2017) was used to specify a VAR model which is shown in equation (1). Where xt is the vector of the endogenous variables: Policy interest rate of the central banks of Canada (RCAN), USA (RUSA) and Mexico, (RMEX).

x

t-i

is the vector of the endogenous variables with t - i lags.  is the vector of the constant terms,

is the vector of the constant terms,  is the matrix of order coefficients (n x n), while

e

t

is the residual term that is distributed as a white noise process.

is the matrix of order coefficients (n x n), while

e

t

is the residual term that is distributed as a white noise process.

To obtain the impulse response functions and show the accumulated reaction of interest rates, equation (1) is transformed to invert the VAR(p) to a VMA (∞), equation (2). Where,  represents the impact multiplier, while

represents the impact multiplier, while  the total multiplier. To estimate the previous VAR model, the unit root tests were first performed to determine if the series meet the white noise assumption or if it is necessary to apply differences to make them stationary.

the total multiplier. To estimate the previous VAR model, the unit root tests were first performed to determine if the series meet the white noise assumption or if it is necessary to apply differences to make them stationary.

Three models were applied: 1) without intercept and without trend; 2) with intercept; and 3) with intercept and trend. In addition, we used the Augmented Dickey Fuller (ADF) Dickey Fuller with Generalized Least Squares (DF-GLS); Kwatkowsky, Phillips, Schimidt, and Shin (KPSS). To strengthen the analysis of whether the series are stationary in presence of structural changes, the Elliott-Rothenberg-Stock (ERS) y Zivot-Andrews (ZA) tests were used. According to the results (see Table 3), the series are I(1), that is, they are stationary after the first difference.

Table 3 Unit roots test

Note: (*) indicates that the test is 95% significant.

Source: Authors´ elaboration.

After having applied the first difference to the variables and make them stationary, a VAR of order 4 was identified, whose specification and stability tests are shown below (Table 4 and Figure 8).

With the VAR model estimated, we proceeded through the Cholesky dof adjusted decomposition to obtain the cumulative impulse response functions (IRF) and determined the reaction of Canadian and Mexican interest rates when they suffer one standard deviation shock to the U.S. rate. The IRFs are shown in Figure 9 with 95 percent confidence interval. According to the cumulative impulse-response function test shown in Panel A and B, any change in FED target rate will have an effect in the same direction on the interest rates of Canada and Mexico. It is also seen that the reaction speed is higher on the Mexican interest rate than on the Canadian. This could be explained considering the high degree of dependence of the Mexican economy on USA.

Therefore, any movement of USA federal funds rate, will trigger a reaction by the monetary authorities of Banxico through modifying its interest rate in the same direction. In the case of the Canadian interest rate, it is observed that it requires more time for the effects generated by a change in the rate of USA federal funds to propagate over the economy to be gradually absorbed.

Table 5 shows through the decomposition of the variance, the time it takes for Canadian and Mexican interest rates to absorb the changes in the USA rate (columns RCAN and RMEX). In this sense, Canada’s interest rate absorbs them gradually, starting with 2.9% in the first period and reaching 34.32% in the eighth period. While Mexico's interest rate absorbs 14.9% in the first period and then decreases in the following periods until reaching an absorption level of 12% in the eighth period. Since Canada's economy is symmetrical with respect to that of USA, its markets adjust gradually. So that the Canadian central bank considers internal conditions to a greater extent and that external factors for taking their monetary policy decisions. Although it should be noted that there is a codependency of USA economy that is reflected in the reaction of the Canadian interest rate to changes in USA interest rate.

Instead, the Mexican interest rate reacts in less time and absorb the effect of a change in USA interest rate, because the Mexican economy is asymmetric and dependent on USA. Therefore, Banxico formulates its monetary policy decisions considering the action of the FED, thus seeking to keep Mexican financial money markets stable. With what is mentioned in this section, it is confirmed that USA economy is the leader, and the actions of the FED will affect the monetary policy decisions of its main NAFTA trading partners. Although it should be noted that the reaction of Canada and Mexico is differentiated due to its degree of symmetry or asymmetry with the leading economy.

Conclusions

Globalization has led countries to a scenario of greater interdependence in the monetary-financial field, so any negative shock or crisis can generate distortions in the real sector. Depending on the degree of interdependence of the economies with the rest of the world, the authorities, particularly the monetary authorities, must coordinate with their peers to maintain the proper functioning of the monetary-financial markets and thus guarantee their stability. This document outlined the need for central banks to coordinate to reduce the adverse effects of crises and financial instability.

Such coordination must be conducted considering the processes of economic integration between the countries, as is the case in the NAFTA. The third section of the document describes the degree of dependency that has been generated between Canada, USA and Mexico since NAFTA went into effect in 1994. According to the literature reviewed, this integration has not only been at the commercial level but also through the financial markets, making it necessary for central banks to coordinate to regulate and supervise the activities of financial intermediaries. Therefore, proper coordination between central banks allows the healthy functioning of financial markets to be maintained, as well as their stability.

However, to achieve a more efficient coordination, the economic structures of the countries must be symmetrical, otherwise there will be a relationship of leading and following countries. As is the case of NAFTA where USA is the country whose monetary-financial markets present a greater development with respect to those of Canada and Mexico. Regarding the Mexican economy, this shows a high degree of asymmetry with respect to USA, so that the monetary policy decisions of Banxico will be aligned to the actions of the FED and to a lesser extent to internal conditions. This dependence is due to the low degree of development of the financial markets. So, to maintain the stability of the Mexican economy, the monetary authorities must anchor its decisions in the same direction as those of the leading country. While in the Canadian economy, being symmetrical with respect to that of USA, the decisions of the Central Bank of Canada not only consider the actions of the FED, but also the internal conditions of the economy.

A VAR model shows the existence of a leader and follower country relationship. With the results obtained, evidence was found that the economies of Canada and Mexico respond in the same direction to the monetary policy decisions of the FED. Thus, confirming that the central banks of the region continue to coordinate around the leading country, USA. According to the literature, in the second section the results obtained can be found online and confirm that the interest rates of the follower countries are determined to a greater extent by external factors than by internal conditions. In the Mexican case, Banxico adopts the monetary policy of the FED to maintain the stability of the economy and financial markets. In the third section, it is shown that the role of the exchange rate in the Mexican economy is to cushion the effects of external shocks, so that they do not affect the performance of financial markets and the interest rate.

According to the sources, economies are required to be symmetrical for adequate coordination between central banks. In this sense, the Mexican economy needs to implement a long-term growth policy to develop and thereby generate enough degrees of freedom for an autonomous monetary policy that is majorly sustained by domestic factors and less by external ones.