Introduction

Empirical studies point out that pandemic and infectious diseases harm the whole economy. Goenka and Liu (2020) introduced a cluster analysis of 114 countries classified as developed, developing, and least developing countries. Their results stress that countries grow at a relatively faster rate in disease-free cases. In disease-endemic cases, countries either grow slower or are in a poverty trap, depending on the human capital investment made. The severity of the disease’s prevalence influences this investment in human capital. Agénor (2015) introduces an overlapping-generations growth model with public capital. He proves that “public spending toward health put the economy on a convergent path to a high growth, high productivity steady state” and points out that “escaping from a health induced poverty trap can occur only if the quality of public spending is sufficiently high.” Acemoglu and Johnson (2007) indicate that differences in disease environments lie at the root of significant income differences across countries today and argue that improving health, human capital, and technology will improve lives and spur rapid economic growth. Recent studies on the Covid-19 outbreak pointed out that household income had a sharp decrease, the unemployment rate significantly increased, and consumer spending fell down cf. Bell and Blanchflower (2020), Bick and Blandin (2020), and Coibion et al. (2020). The literature above highlights that the impact of the pandemic and infectious diseases is different between countries due to differences in their economic structure.

We introduced a neoclassical growth model to analyze the impact of the pandemic and infectious diseases in the economy's supply-side and found similar results to the literature above. In our model, the exogenous shock reduces the marginal product of labor. Thus, in a country with low initial capital, the household income considerably reduces and might fall into a poverty trap under some conditions. Meanwhile, countries with a high initial capital level will recover faster after the exogenous shock. This model (used by Englmann (1994), Reati (1998), and Foster and Wild (1999)) introduces the Richard production function due to the curved shape it allows to depict the three levels of production: innovation, growth, and saturation. We use the Richard function to describe the different stages of industrialization; in this context, any economy with low initial capital represents an economy with a low level of technology; conversely, high initial capital depicts an economy with a high level of technology. The Richard function has an "S-shape" curve, which implies decreasing and increasing marginal product of labor. This feature allows depicting the procyclical and acyclical productivity of labor. Biddle (2014) shows an exhaustive summary of the cyclical behavior of labor productivity and their controversies and points out that procyclical behavior contradicts the neoclassical theory because of the assumption of marginal product in the neoclassical production function. Finally, we show that improving human capital and introducing better technologies in productive sectors allow a country to overcome the poverty trap.

The rest of the paper has three other sections; the following section describes the Richard function's analytical properties. The third section introduces the neoclassical growth model and the main theorem that stresses the impact of the exogenous shock. The fourth section describes the effects of the exogenous shock, the cyclical productivity, and the poverty trap-finally, the conclusion and possible extensions of the work.

The Richard function.

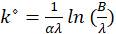

We call Richard function1 or generalized logistic function to

The parameter A is the level of saturation or maximum value that f(k) reach, α is the growth rate, λ > 0 determines the inflection point of the curve, and the constant

depend on the initial condition of the differential equation2 Notice that, if λ = B = 1 in equation (1), we get the logistic function. The Richard function or functions with "S-type curve" was used in the last decade for various economists to model the process of technological change or innovation because this function captures the three stages of production (innovation, growth, and saturation). Therefore describes the workforce's limited development and brings up generalizations of the Solow and Ramsey models, cf. Scarpello and Ritelli (2003),

Guerrini (2006),

Accinelli and Brida (2007),

Brida (2008),

Ferrara and Guerrini (2009),

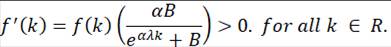

Guerrini (2010). Plata et al. (2017) introduced the Richard function as a production function in the Solow and Ramsey models, showing that poverty traps arise naturally. Differing from Plata et al. (2017), we focus on the parameter λ of the function (1) to represent the improvements in the technology after the exogenous shock to recover the productivity. From elementary calculus, we get

depend on the initial condition of the differential equation2 Notice that, if λ = B = 1 in equation (1), we get the logistic function. The Richard function or functions with "S-type curve" was used in the last decade for various economists to model the process of technological change or innovation because this function captures the three stages of production (innovation, growth, and saturation). Therefore describes the workforce's limited development and brings up generalizations of the Solow and Ramsey models, cf. Scarpello and Ritelli (2003),

Guerrini (2006),

Accinelli and Brida (2007),

Brida (2008),

Ferrara and Guerrini (2009),

Guerrini (2010). Plata et al. (2017) introduced the Richard function as a production function in the Solow and Ramsey models, showing that poverty traps arise naturally. Differing from Plata et al. (2017), we focus on the parameter λ of the function (1) to represent the improvements in the technology after the exogenous shock to recover the productivity. From elementary calculus, we get

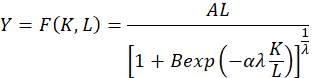

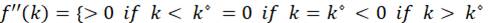

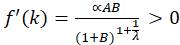

which it implies that the Richard function is increasing, moreover

Therefore, the convexity of f(k) is subject to the identity , solving for k, we get

, solving for k, we get

The next proposition summarizes the above equations.

Proposition 1. The Richard function satisfies, 0 < f (k) < A, is strictly increasing in R, with inflection point  is convex in (−∞, k

⬦

) and concave in (k

⬦

, ∞).

is convex in (−∞, k

⬦

) and concave in (k

⬦

, ∞).

Neoclassical properties.

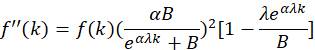

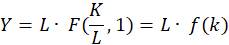

The Richard function has interesting properties that fit with the production process. However, it does not properly satisfy the axioms of the neoclassical production function. Assuming the function

where K and L are variables denoting capital and labor respectively. Notice that the above function has constant returns to scale and by the homogeneity we get

where  and f(k) is the Richard function. The partial derivatives of Y = L f (k) and the inequalities (3) follows the next proposition

and f(k) is the Richard function. The partial derivatives of Y = L f (k) and the inequalities (3) follows the next proposition

Proposition 2. Let α, λ, A and B, be positive parameters of the Richard function, k

⋄

=  the inflection point of 𝑓(𝑘), then for any k ≥ 0 it satisfies the following

the inflection point of 𝑓(𝑘), then for any k ≥ 0 it satisfies the following

where

Proposition 2 shows that the Richard production function has increasing and decreasing marginal returns for k < k⬦ and k > k⬦, respectively. As Sachs et al. (2004) stressed, this feature is feasible for any firm, “is needed a minimum threshold of capital before the modern pro-duction processes started.” They explained that factory production requires roads, ports access, and literate and numerate workers. Without these basic conditions, at a low level of k, the marginal productivity will be negligible, even negative, under some assumptions. Nevertheless, when capital has reached basic infrastructure and human capital, the marginal productivity of capital and labor might become high and grow faster in a low-income country until it achieves the saturation level. Finally, the marginal productivity will become slower and decrease. Indeed, growth theory literature names the variability of marginal returns of the production function as “non-convexities in the production function” cf. Azariadis and Stachurski (2005).

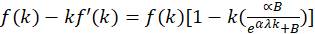

From equations (2) and (5), follows that the marginal product of labor depends on the parameters B and λ, due to  . Therefore, we have the next proposition.

. Therefore, we have the next proposition.

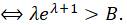

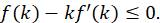

Proposition 3. If the parameters λ and B satisfies λeλ+1 > B, then for any k > 0 we get

At this moment is not easy to see the conditions over the parameters B and λ satisfying (8); however, keep in mind that in a perfect competitive economy the wage is defined by  , the traditional assumption in the neoclassical model is

, the traditional assumption in the neoclassical model is  Now, proposition 3 points out the inequality (8) may reverse for some conditions of B and λ, as we will show in theorem 1. Finally, the Richard function does not satisfy the first Inada condition because

Now, proposition 3 points out the inequality (8) may reverse for some conditions of B and λ, as we will show in theorem 1. Finally, the Richard function does not satisfy the first Inada condition because

Inada (1963) introduced two mathematical conditions in the production function to ensure the existence and unicity of the steady-state in a neoclassical growth model. These conditions do not represent any natural state of production. Therefore, the production function may be well-founded without Inada conditions.

Neoclassical growth model with Richard production function

This section develops a neoclassical growth model introducing the Richard production function and the implications of the exogenous shock on economic growth.

Elementary assumptions.

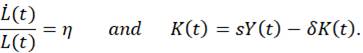

Assume a close economy with a Richard production function F(K, L) as defined in (4), with constant returns to scale in the two inputs, capital K and labor L. Let 0 < s < 1 be marginal propensity to save, assume a constant fraction of the net production sY(t) allocated to the creation of new capital, it depreciates at a fixed rate δ, in addition, the labor force grows at a constant rate η. Therefore, the trajectories of L(t) and K(t) are described by

The production factors assume a perfectly competitive assignment, thus wage and capital rate are equal to the marginal product of its factors

From the equations (10) and Euler’s theorem for homogeneous functions, follows that

This model also assumes that firms maximize their income and market factors are exhausted, i.e., the demand for labor and capital are equal to the supply of the factors. Furthermore, we assume the classical hypothesis “the workers do not save, and the capitalist does not consume” cf. Wray (1991); therefore, we have the equality sY(t) = rK(t). All variables depend on time; therefore. we omit the notation of t. Now we introduce the per capita variables, let  and

and  be the aggregates capital and product per capita, respectively. Notices that y = f (k); hence, in per capita terms, we have the following equality

be the aggregates capital and product per capita, respectively. Notices that y = f (k); hence, in per capita terms, we have the following equality

It is useful to express the identities (10) as follow

Competitive market wage curve.

In proposition 3, the inequality over the parameters λ and B was not clear and gave conditions that the wage could be negative. We will first prove the inequality, and then explain the economic meaning of the parameters λ and β

From inequality (7), follows the next result.

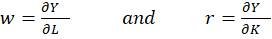

Lemma 1 (Slope of the CMW-curve). Let w be the CMW-curve in the industrial sector, then

is decreasing for k < k ⋄ , increasing for k > k ⋄ , and reach the minimum when k = k ⋄ .

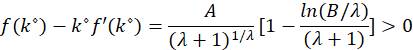

Evaluating the identity (14) in the inflection point  , we get

, we get

If  , then

, then  ; therefore

; therefore  . Finally, reversing the previous inequalities we get the next theorem.

. Finally, reversing the previous inequalities we get the next theorem.

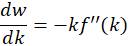

Theorem 1 (CMW-curve). Assume the Richard production function 𝑓(𝑘), its derivative f `(k), and k⋄ is the inflection point of 𝑓(𝑘).

If  , then exists an interval U centered in k⋄, such that for all

, then exists an interval U centered in k⋄, such that for all  satisfies

satisfies

If  , then for all 𝑘 ≥0 satisfies

, then for all 𝑘 ≥0 satisfies

The impact of exogenous shock.

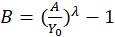

This section describes the impact of shocks in the neoclassical growth model; we are considering exogenous shocks that directly affect the supply, like pandemic and infectious diseases that negatively impact human capital, employment, and productivity. In Theorem 1, the parameter B of the Richard function depends on the initial conditions of the Bernoulli differential equation; therefore, we denote B0 to the initial conditions of the economy before the impact of pandemic and infectious diseases cf. figure 1-(a), and let B> B0 the negative exogenous shock in the economy, see figures 1-(b) and (c). Meanwhile, λeλ+1 depict the productive capacity in the economy; in consequence, Theorem 1 implies the next claim.

Claim 1.

Assuming the pandemic and infectious diseases have a negative exogenous shock, then the marginal product of labor and household income decrease due to the affectation of the labor force, moreover

If the exogenous shock is greater than productive capacity, underdeveloped countries will fall into a poverty trap induced by the diminution of the labor force and household income. In developed countries, labor force and household income also reduce, but they will recover faster.

If the exogenous shock is smaller than productive capacity, then the average production decreases in underdeveloped countries and increases in developed countries.

a) B0 =25

Figure 1.a Richard function and CMW-curve with two different negative shocks B 1 and B 2 .

b) B1 =25

c)B2 =35

Figure 1.b Richard function and CMW-curve with two different negative shocks B 1 and B 2 .

Pandemic and infectious diseases.

Representative studies about infectious diseases like Goenka and Liu (2020), Agénor (2015), and Acemoglu and Johnson (2007) show that diseases have a negative impact on the labor force, productivity, and GDP. Acemoglu and Johnson (2007) pointed out that affectation in low-income countries is higher than in high-income countries. On the other hand, Goenka and Liu (2020) claim that developed countries have control of diseases or are disease-free, therefore grow at a faster rate, while developing countries have disease-endemic cases and either grow at a slower rate or are in a poverty trap. Theorem 1-(a) shows that infectious diseases that affect a considerable part of the labor population in a country with low initial capital will fall into a poverty trap. Meanwhile, countries with a high initial capital level after a high-impact shock will recover faster. On the other hand, Chou et al. (2004), Hai et al. (2004), and Siu and Wong (2004) showed that the 2003 SARS outbreak had a significant GDP decline in the service and manufacturing sectors. Bell and Blanchflower (2020), Bick and Blandin (2020), and Coibion et al. (2020), centered on the Covid-19 outbreak, pointed out that household income had a sharp decrease, the unemployment rate had significantly increased, and the consumer spending fell. Theorem 1 perfectly depicts the diminution of the wage after a negative shock that affected the supply side; hence it matches with the empirical studies mentioned above. The fast recovery of the developed countries after exogenous shocks has many explanations in empirical studies. One of them is the human capital and technological advances, distinctive of the developed countries cf. Acemoglu and Zilibotti (2001), Acemoglu (2002), and Acemoglu and Johnson (2007). In this model we emphasize that the Richard function describes the different stages of industrialization. In this context, any economy with an initial capital k > k⬦, describes an economy with a high level of technology. The Richard function curve increases rapidly for these values of k, which means that a reduced labor force makes efficient use of available technology.

Cyclicality of labor Productivity.

The neoclassical production function assumes diminishing marginal product in both inputs capital and labor; this implies that average labor productivity has countercyclical behavior, which contradicts the empirical findings that point out the labor productivity is procyclical (rising in recessions, falling in booms). Biddle (2014) shows a broad summary of the cyclical behavior of labor productivity in the early 1920s to 1960s and analyzes relevant studies over this period. Indeed, Robert Solow (1964) called “perverse behavior of productivity in the short run” to procyclical behavior of the productivity because it does not match with the standard neoclassical theory. The shape of the Richard function curve implies decreasing and increasing marginal product of labor cf. Lemma 1; as a result, Theorem 1, states that after a negative exogenous shock, the aggregate productivity reduces, for values k < k⬦ the marginal product of labor decreases sharply, and the marginal product of labor increases faster for values k > k⬦, as shown in figure1. In this context, an economy with initial capital k < k⬦, represent a country with a low level of technology or an underdeveloped country, in consequence, the productivity falls due to lag in technology. Conversely, in countries with a high level of technology, productivity grows faster, even in times of recession. The cyclicality of productivity is a controversial subject until now. Dossche et al. (2021), Fermand and Wang (2016), and Biddle (2014), bring up several empirical explanations about it.

Overcoming the poverty trap.

Theorem 1 claims that a country with a low level of technology may fall into a poverty trap after an exogenous shock because the shock surpasses the productive capacity. Indeed, the shock impacts the marginal product of labor; in consequence, the household income decreases in the proportion of the shock, thus explaining poverty traps and other factors avowed in the literature cf. Azariadis and Stachurski (2005) and Azariadis (2006). On the other hand, Romer (1986), and Lucas (1988), stressed the importance of human capital and technological improvements in productivity and economic growth. In several works, Daron Acemoglu claims that investment in technology and human capital will allow developing countries to attain better income and welfare in the long term. “Encouraging the development of technologies more appropriate to the LDCs could therefore reduce the output gap” Acemoglu and Zilibotti (2001). In Theorem 1, the inequality 𝐵≥𝜆 𝑒 𝜆+1 , induces a poverty trap. Note that adequate increases in λ changes the inequality, thus representing improvements in productive capacity, corresponding with the implementation of better technologies and human capital, as suggested in the literature above. Figure 2, shows the CMW-curve after the exogenous shock denoted by B = 45 and parameter λ = 2. Note the CMW-curve reach very low values, even negative for 𝑘∈(4,6). The negative values correspond with the exogenous shock that surpassed the productive capacity, leaving the economy with almost all economic sectors down and only a small number of operating firms, with deplorable physical and human capital, and using lagged technologies. These are the features of the poverty trap. Increases in the parameter λ allows to overcome the poverty trap as shows in figures 2-(a) and (b).

a) Overcoming poverty trap by increasing λ0=2 to λ1=2.2

Figure 2.a Function and CMW-curve with initial λ0=2 , and a perturbation λ1=2.2.

b) Parameters λ0=2 and λ1=2.2 .

Figure 2.b and CMW-curve with initial λ0=2, and a perturbation λ1=2.2.

Conclusions

The curve shape of the Richard function bears non-convexities in the production, allowing us to depict the three stages of production (innovation, growth, and saturation). Consequently, we use it to represent the technological levels of the countries. If the initial capital is a low level of k, then it is categorized as an underdeveloped country. Otherwise, initial capital with a high level of k describes a developed country.

Lemma 1 describes the marginal product of labor and gives rise to conditions that drive wages into a poverty trap. It also describes the cyclical behavior of labor productivity under the characteristic of technological levels of the countries. This model explains procyclical labor productivity in underdeveloped countries and countercyclical production for developed countries. Meanwhile, the neoclassical model only explains countercyclical production. In Theorem 1, the exogenous parameter B, and the term λeλ+1 describes the productive capacity of the economy. The relation between these parameters allows analyses of exogenous shocks' impact on the supply labor. In addition, it introduces a poverty trap arising from the supply side, low wages indeed. We demonstrate that incorporating modern technology and improvements in human capital are necessary conditions to overcome the poverty trap. Finally, Theorem 1, allows to propose public policies:

To avoid falling into a poverty trap before an exogenous shock, the government needs to invest in human capital and allow the industrialization of the economy through modern technologies.

To hasten exit from the poverty trap, the necessary conditions are to introduce modern technologies in the productive sectors and improve human capital.

A possible extension for this model is to introduce monetary policy to incorporate monetary aid in underdeveloped countries aimed to nudge the exit from the poverty trap or avoid falling into poverty trap before an exogenous shock.